Gasparino Rips JPMorgan Boss for Playing ‘Footsie’ with DEI

Fox Business Senior Correspondent Charlie Gasparino took JPMorgan Chase CEO Jamie Dimon to task for pushing radical and discriminatory diversity, equity and inclusion (DEI) initiatives.

Can’t Make This Up: WashPost Cites Debunked Study to Push DEI

Two writers for The Washington Post tried to make the case for discriminatory diversity equity and inclusion initiatives (DEI) in an article about DEI’s rebranding. However, they relied on debunked research to do it.

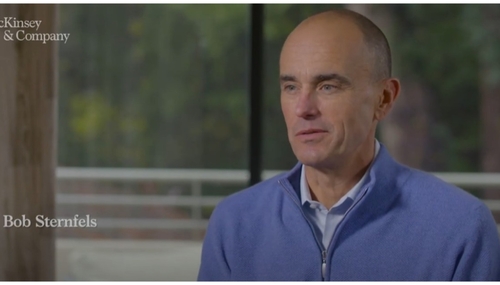

Too Many Corporations, Like Universities, Have Lost Their Way

Universities are not alone among our institutions that have lost their way. How about America’s corporations, which now seem to think social justice is their job, beside efficiently delivering goods and services to the American public? In a recent panel discussion at the Bipartisan Policy Institute, Jamie Dimon, chairman and CEO of JPMorgan, the nation’s largest bank, rang the alarm about the…

JP Morgan CEO Attacks Demonization of Trump, MAGA Supporters

JP Morgan CEO Jamie Dimon stood up for former president Donald Trump and his supporters while discussing the state of the economy.

JPMorgan Chase CEO Warns Against Halt to Gas Use on CNBC; Musk Agrees

JPMorgan Chase CEO Jamie Dimon dealt leftists a dose of energy infrastructure reality on CNBC’s Squawk Box Thursday.

Liberal Media Go GAGA for Former MSNBC Analyst Leading WH Briefing

The Psaki Show took a break on Wednesday from the White House Briefing Room and instead gave way to a guest episode led by her top lieutenant in Principal White House Deputy Press Secretary and former MSNBC contributor Karine Jean-Pierre. Naturally, this led more than a few liberal journalists and pundits to wax poetic about her becoming the second Black woman to lead a briefing and the first…

Liberal Media Hype ‘Recession’ Fears Every Single Day in June and July

Chase CEO Credits Trump, Tells Yahoo Tax Reform Was 'Needed'

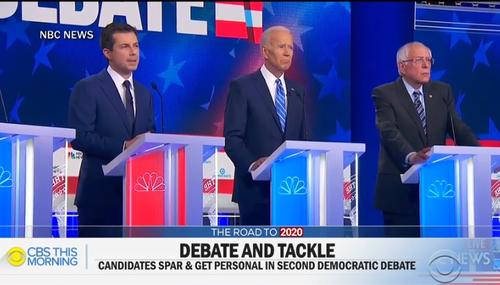

CBS Offers Liberal Economic 'Facts' Before Debates

AP on Record-Low Black Jobless Rate: 'Taking Chances' on the 'Ignored'

CEO Dimon Upbeat on Economy, But CBS Still Hits Him from Left

Nets Censor 4% Economic Growth Prediction from JP Morgan CEO

Stocks Reach 16 Records, Nets Only Credit Trump 6 Times