Lib Economist WARNS CNN of ‘Uncomfortably High’ Recession Odds

March 29th, 2022 3:41 PM

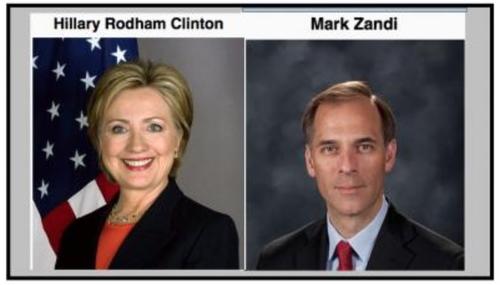

A high-profile liberal economist, and reported Hillary Clinton donor, said that the chances of recession in the U.S. are looking increasingly more likely, according to CNN. Moody Analytics Chief Economist Mark Zandi reportedly said that the “US economy has at least a one-in-three chance of sinking into a recession over the next 12 months,” CNN Business summarized.

The Hill Belches Dem Sweep ‘Would Bring Biggest Boost to Economy’

September 29th, 2020 12:12 PM

The Hill just did some vomit-inducing PR for Democratic presidential nominee Joe Biden and other Democrats on the economy. It cited economists from an organization that had predicted economic disaster under President Donald Trump in 2016.

Bloomberg Politics Warns ‘Watch Out’ for Potential 2020 Recession

March 28th, 2018 11:42 AM

Even though the U.S. economy grew at a 2.9 percent pace in the final quarter of 2017, some in the liberal press have already begun to anticipate a recession — at the worst, possible time for President Donald Trump.

On Trump Tariffs, AP Reporter Tries to Frighten, Misquotes Economist

March 11th, 2018 10:18 PM

The Associated Press's Paul Wiseman has apparently tired of good economic news. Saturday, the AP reporter painted a frightening picture of what a trade war based on President Donald Trump's planned tariffs on a tiny sliver of U.S. imports might do to the world's economy, mischaracterizing a prominent economist's position to build his case.

Shhh! Six Months After Brexit Vote, UK 'Has World's Top Economy'

January 7th, 2017 8:46 AM

In June, when UK voters decided to leave the European Union in the "Brexit" referendum, the U.S. press told the American people that the UK economy would suffer greatly as a result. Moody's economist and max Hillary Clinton contributor Mark Zandi predicted that it would be "going down the rabbit hole." At CBS News, Mellody Hobson said that "they're acting as if a recession is a foregone…

After AP Sets Ceiling, Economic Growth Forecasts Get Bumped Up

November 18th, 2016 10:49 AM

The Associated Press's coverage of the U.S. economy is undergoing its own presidential transition. One might expect a bit of chaos as the AP moves from frequently and inordinately praising and defending the historically awful economy we've seen during the past eight years under a Democratic administration to eventually downplaying and bashing it at every opportunity once a Republican takes over.…

The Obama Economy: Worse Than the Great Depression on One Key Metric

November 7th, 2016 1:37 PM

If you believe the Obama administration, the Hillary Clinton campaign and their apparatchiks in the press — and as we've learned during the past several weeks, all three work assiduously to sing from the same hymnal — the economy we've seen during the presidency of Barack Obama has been one of slow but still acceptable recovery and (yes, this word has been frequently used) "durable" expansion.

UK Data Refutes Media Gloom: There's Been No Brexit Economic Disaster

August 20th, 2016 11:58 PM

After 52 percent of voters in Great Britain cast their ballots in favor of leaving the European Union on June 23, financial commentators around the world, particularly in the U.S., predicted ugly economic tidings for the UK.

People who swallowed the gloom and doom whole must have been especially surprised early Friday morning when Bloomberg News published a piece headlined "Pro-Leave Economists…

Hillary Donor Mark Zandi: Economy 'Resilient,' Job Market 'Incredible'

July 30th, 2016 6:52 PM

Yesterday's news about the economy was the latest in a 7-1/2 year series of mostly regular disappointments. The government reported that nation's Gross Domestic Product (GDP) grew at an annual rate of just 1.2 percent in the second quarter, half or less of what most alleged "experts" expected. Additionally, the first's quarter's originally reported 1.1 percent growth was revised down to 0.8…

Video

On Brexit, CBS's Economic 'Experts' Show Partisanship and Ignorance

June 29th, 2016 11:58 PM

CBS broadcasts discussing the Brexit Leave vote on Sunday and Monday went to economic "experts" whose "analysis" betrayed partisanship and both feigned and real ignorance. On Sunday on Face the Nation, max 2015 Hillary contributor (as usual, not disclosed to viewers) Mark Zandi of Moody's Analytics predicted that that the UK economy "is going down the rabbit hole" as the result of the Leave…

Moody's Predicts First-Quarter Contraction — and Hides It

April 18th, 2016 7:19 PM

Longtime readers know that if the current stagnating economy were occurring during a Republican or conservative presidential administration, the press would be searching high and low to find a "respected" economist or analyst forecasting the beginning of an economic contraction while screaming that a recession is just around the corner. Instead, the business press has stuck to saying that "most…

AP's Econ Writers Hype 'Healthy' Job Market, Ignore Flat Pay

April 4th, 2016 5:02 PM

The Associated Press, the nation's de facto business news gatekeeper for those who don't follow the economy or the markets closely, is telling America that the U.S. job market is fine, and ignoring the dismal results seen in weekly pay during the past several months.

Christopher Rugaber's Friday evening coverage of the government's jobs report earlier in the day described the reported 215,000 in…

Mark Zandi, Economy's Cheerleader, Gave the Max to Hillary Last Year

March 30th, 2016 10:35 PM

Mark Zandi, Moody's chief economist, comments monthly on the ADP private-sector employment report his firm compiles. He is "often quoted in national and global publications and interviewed by major news media outlets, and is a frequent guest on CNBC, NPR, Meet the Press, CNN, and various other national networks and news programs."

Zandi has also been the economy's head cheerleader during much of…

AP's Crutsinger: 3rd Qtr. Was 'Subpar,' But Future 'Outlook Brightens'

October 28th, 2015 8:31 PM

Preparing the battlespace for tomorrow's report from the government on third-quarter Gross Domestic Product growth, the Associated Press's Martin Crutsinger early this afternoon told readers that we're likely to see "a subpar pace by any standard."

But we shouldn't worry, because the AP reporter contends that tomorrow's news will just be a temporary trough in this year's "dizzying roller coaster…