If you're a few hours late catching up on reports on economic data at the Associated Press, one of the best ways to determine whether the news was good or disappointing is to see whether the story's headline and opening blurb are still present about four hours later among the wire service's "Top (usually 10) Business News" items. The good-news items will usually still be there; the disappointing ones will usually be gone.

Sure enough, as of about 12:30, Martin Crutsinger's dispatch in the wake of the 8:30 a.m. Durable Goods report from the Census Bureau was no longer a Top Story. That's because, even though Crutsinger did his level best to ignore pertinent facts and try to pin the blame elsewhere, the news was awful.

The bureau's Advance Report on Durable Goods estimated that seasonally adjusted durable goods orders dropped 1.2 percent in September. That actually beat expectations of between -1.3 percent and -2.0 percent, but only because August was revised down to -3.0 percent from -2.3 percent.

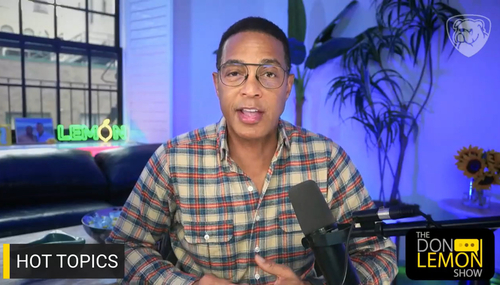

The AP's Crutsinger noted those facts, but "somehow" didn't make any of the troubling points made in the highlighted boxes in the graphic below containing the latest orders and shipments data:

Crutsinger also played the tired "it's the rest of the world's fault" tune we've been hearing more and more from the Obama administration's business press defenders:

ORDERS FOR US DURABLE GOODS DOWN 1.2 PERCENT IN SEPTEMBER

Orders for long-lasting manufactured goods fell in September, with a key category that tracks business investment plans declining for a second straight month.

Orders for durable goods dropped 1.2 percent September, the Commerce Department said Tuesday. That follows a 3 percent drop in August, an even bigger downturn than first reported.

Orders in a category that serves as a proxy for business investment fell 0.3 percent after a 1.6 percent drop in August.

Durable goods orders have been down in four of the past six months, a sign of the problems facing manufacturers as they struggle with economic weakness in key export markets like China.

To be clear, Crutsinger's "four of the past six months" refers to "from one (seasonally adjusted) month to the next."

His exports-related excuse for the U.S. economy's slowdown is thin gruel.

While exports are down, the real problem, as it has been since the Obama administration took office, is that growth in U.S. consumer and business spending and investment has badly trailed that seen in previous and more genuine recoveries.

As seen here at Exhibits 14 and 14a, U.S. exports of goods have declined by about 6 percent through the first eight months of this year compared to 2014 ($1.009 trillion vs. $1.073 trillion). Annualized, the decline is about $100 billion, or 0.6 percent of U.S. GDP. (Exports of services, as seen in Exhibit 20a, have been slowly increasing for several quarters.) So the rest any demonstrated weakness is on us. Incomes are stagnant and businesses are relatively pessimistic about future domestic prospects.

Though the pace of the year-over-year decline in overall exports is accelerating, China, the one country Crutsinger named, is not the culprit. Exports to China are down by 3.7 percent year-to-date, but they were up by an admittedly tiny but still positive 0.3 percent during the most recent three months. So if anything, China is cushioning the blow from declining exports elsewhere.

It should also be noted, for those who truly want to assign fault, that declining exports is a sign that countries which have followed the U.S.-pressured and U.S.-"inspired" Keynesian playlook are seeing even worse results in their economies than we've seen here. So in that sense, even aside from strong-dollar arguments, the U.S. deserves a hefty share of the blame if their trading partners are less inclined to buy as much stuff from us.

Two other points from Crutsinger's writeup:

Consumer demand for autos has been strong, with auto sales in September rising nearly 16 percent from a year ago to their highest peak in nearly a decade.

But outside of cars, consumers are spending cautiously. Overall retail sales have grown only modestly in the past two months. ...

... Many (economists) are projecting GDP to expand at a 1.7 percent (annualized) rate in the July-September period.

The reason the auto industry is "selling" so many cars is that consumers aren't having to "spend" money to get behind the wheel. Credit standards are lax, down payments generally range from small to nothing, and the average length of a new car loan is an astonishing 6-1/2 years. There are already signs that a large increase in repossessions may be in the offing. If the economy slows down significantly, that problem could ripple through the entire auto industry all the way back to the assembly line.

As to GOP growth, "many" economists may be projecting 1.7 percent annualized GDP growth, but "many" are also projecting a significantly lower figure. Both the Atlanta Fed and Moody's are projecting 0.8 percent as of today.

Tables like the ones seen above leave one wondering how Thursday's GDP figure will even reach that lower figure.

Cross-posted at BizzyBlog.com.