The New York Times came out with a story on rising car payment delinquencies that at first glance would make readers think it was President Donald Trump’s fault. But — as always — the devil’s in the details: This issue was a lingering carry-over from the Biden administration.

“Lower-Income Americans Are Missing Car Payments,” Times business reporter Sydney Ember’s October 20 headline read. She wrote that “Inflation and a tough job market are making it harder for some people to pay back the car loans they signed in better times.”

“Lower-Income Americans Are Missing Car Payments,” Times business reporter Sydney Ember’s October 20 headline read. She wrote that “Inflation and a tough job market are making it harder for some people to pay back the car loans they signed in better times.”

Sounds pretty bad, unless you’re a political opportunist looking to whack Trump with any political cudgel you can get your hands on. But the hidden plot twist would make anyone paying attention do a double-take: “The share of subprime auto loans that were 60 days or more past due reached a high of nearly 6.5 percent in January and has lingered near that level, according to Fitch Ratings.”

Hmm, who was president for most of January? Because it certainly wasn’t Trump. Ember never mentions Biden at all — of course —and proceeded to keep her story devoid of the necessary context:

[T]he weakness in the auto market is one of the clearest indications that low- and middle-income families — the economy’s foundation — could be starting to buckle. Because many Americans need their cars to get around, auto loan delinquencies can be a telling gauge of financial hardship.

But this has been an inflationary problem that long preceded Trump’s administration. NewsNation reported in March that “Americans owed a record $1.66 trillion in auto loan debt at the end of 2024, up 20% since 2020.” In 2023, the Institute for Energy Research estimated that “the average new car loan now has a monthly payment of over $750, with an interest rate of 9.5 percent. For used cars, the average car interest rate is 13.7 percent” in Biden’s America.

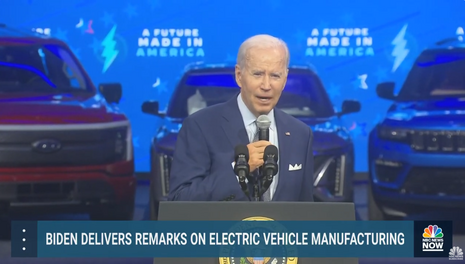

In fact, the IER directly attributed the phenomenon to Biden's climate change-obsessed regulatory crackdowns: "As Biden continues with his net zero carbon policies, his regulatory costs are skyrocketing and prices reflect that."

Readers wouldn’t know until the 23rd paragraph of Ember’s piece that “newer auto loans appear to be performing better than loans that originated in 2022 and 2023. That could be because lenders have tightened their loan requirements, preventing low-credit-score borrowers from securing risky loans so freely.” See what’s going on here?

It shouldn’t surprise anybody that The Times is attempting to cover up the mess that Bidenomics created over the past four years, given that it endorsed both Biden and his lefty former heir apparent Vice President Kamala Harris. But it’s an even bigger slap to the face when everybody and their mother knows where a major economic problem originated from and the supposed newspaper of record tries to pretend it doesn’t exist.