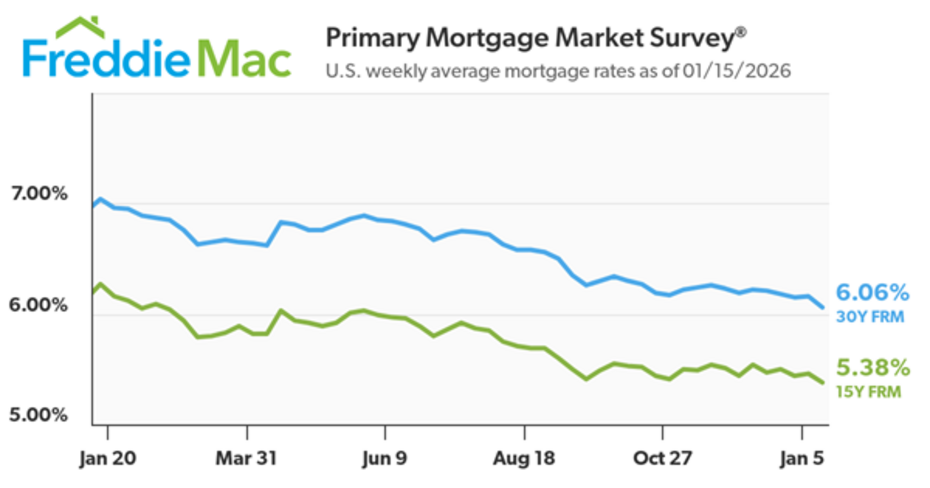

Mortgage rates have fallen to their lowest level in more than three years, Freddie Mac announced Thursday, releasing results of its latest weekly Primary Mortgage Market Survey (PMMS®).

In its announcement, Freddie Mac reports:

- The 30-year fixed-rate mortgage (FRM) averaged 6.06%, down from 6.16% last week and 7.04% a year ago.

- At 6.16%, the 30-year FRM is the lowest in more than three years.

- The 15-year FRM averaged 5.38%, down from 5.46% the previous week and 6.27% year-ago.

“The impacts are noticeable, as weekly purchase applications and refinance activity have jumped, underscoring the benefits for both buyers and current owners,” Freddie Mac Chief Economist Sam Khater noted:

“The impacts are noticeable, as weekly purchase applications and refinance activity have jumped, underscoring the benefits for both buyers and current owners,” Freddie Mac Chief Economist Sam Khater noted:

“It’s clear that housing activity is improving and poised for a solid spring sales season.”

On Thursday, the Mortgage Bankers Association (MBA) reported survey results showing that mortgage applications for new home purchases in December increased 2.5% from a year ago. Additionally, the MBA reported that its Refinance Index increased 40% from the previous week and 128% from year-ago, while its seasonally adjusted Purchase Index increased 16% from a week earlier.

new home purchases in December increased 2.5% from a year ago. Additionally, the MBA reported that its Refinance Index increased 40% from the previous week and 128% from year-ago, while its seasonally adjusted Purchase Index increased 16% from a week earlier.

On Wednesday, the MBA reported that the its weekly survey found that mortgage applications were up 28.5% from last week.

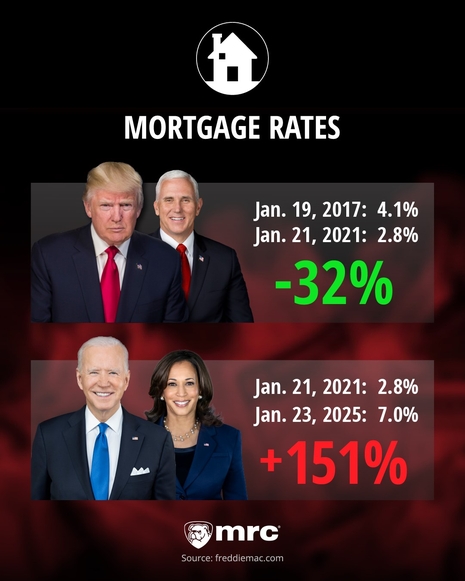

When President Donald Trump began his second term in the White House a year ago in January of 2025, 30-year fixed rate mortgages averaged 7.0%, more than four percentage points higher than the 2.8% average rate when he left office in January of 2021. During his first term, the average rate decline by 1.3 percentage points.