HA! CNN Admits ‘Trump Is Right: The Economy Is Strong’ Post-SOTU

It’s been proven that CNN will never give President Donald Trump an inch on a “strong” economy without taking logic and twisting it into such an amorphous pretzel to take nonsensical jabs at his record anyway.

CNN Obsessed With Eking Out A Win on Dumb Trump Economy Scare Porn

CNN Business’s so-called “senior writer” Alicia (not Nicolle) Wallace can’t seem to get the hint that her ongoing narrative war against the Trump economy is flopping harder than Joe Biden’s mental acuity.

‘BAD BREATH!’ WashPost Spews Hot Air on Trump Ruining Valentine’s Day

The Washington Post Editorial Board couldn’t have timed its faux-fussbudgeting over how the Trump tariffs were supposedly juicing Valentine’s Day inflation more perfectly (sarcasm). News was just released that inflation eased in January.

CNN's Spin on Inflation: 'Falling' for Biden, 'Persistent' for Trump

The internet is forever! At least that’s a concept most people on the internet besides CNN seem to grasp. On Tuesday, CNN made its double standard on inflation so nakedly apparent it needs an NC-17 rating. Inflation under Biden was "falling," but under Trump it's "persistent....as high prices continue to weigh on many Americans."

Pin the Tail on the Jackass: CNBC Blames Biden for Affordability Issue

It’s always great TV when the business journos over at CNBC take a wrecking ball to the media’s never-ending croaking against the Trump administration for an affordability issue they pretended wasn’t such a big deal under its predecessor.

CNN Tries Having It Both Ways With Dumbest Trump Economy Griping Yet

Narrative consistency on economic coverage is definitely not one of CNN’s strongest suits, and its latest pile of garbage it spewed to harangue President Donald Trump’s economy is case-in-point.

Tough Noogies, Naysayers: CNN’s Scott Jennings Defends Trump’s Tariffs

While the leftist media scramble to retain whatever illusory credibility they think they have over their eroding predictions of a Trumpian economic disaster, CNN’s tour de force Scott Jennings took to ABC’s This Week to list off some of the president’s W’s.

EXCLUSIVE: Apple Bank CEO Explores State of U.S. Capitalism with MRC

Steven C. Bush, chairman, president, and CEO of Apple Bank— the largest state-chartered savings bank in New York state — spoke with MRC Business about his optimism for the future of American capitalism amid troubling trends.

New York Times Mangles It: 'Trump Calls Affordability a Con Job'

Leave it to The New York Times to try to channel its Fine People Hoax energy to once again twist President Donald Trump’s words to make him seem like a Bond villain who scoffs at the plebeians' struggles against inflation.

Holy Cow! WashPost Tells Americans ‘You May Not Want Lower Prices’

Sometimes leftist media outlets try to out-dumb themselves like it’s some sort of prestigious competition for who can churn out the most ignoramus hot take of the year. The Washington Post is definitely in the running for first place with its latest stupidity about inflation.

All Five Least Affordable States For Housing Run By Democrats

While affordability has become a major Democrat talking point, research shows that states run by Democrat governors are the least affordable in the nation. A study by Realtor.com finds that all five of the least affordable states for housing have Democrat governors. Meanwhile, four of the five most affordable states for housing have Republican governors.

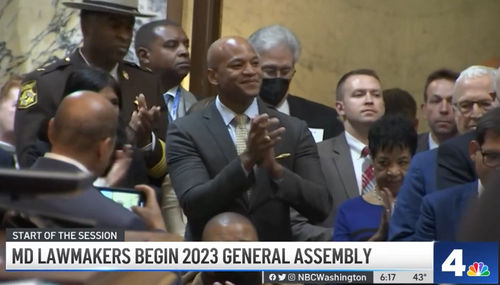

Baltimore Sun Rips Maryland Lefties for Taxing, Spending State to Hell

Maryland’s largest newspaper is turning on lefty lawmakers at the state capital for being largely responsible for creating the economic crisis the Old Line State faces today.

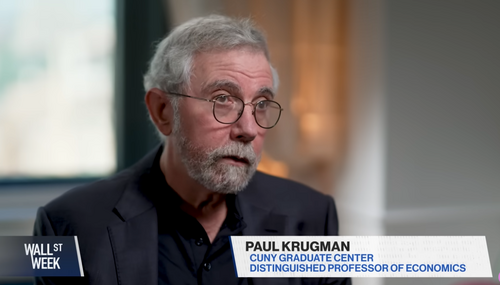

Delusional Paul Krugman Accuses Trump of Losing ‘Touch with Reality’

We’ve just received yet another dispatch from the Imaginarium of Dr. Faux-nassus — otherwise known as Paul Krugman — who had the chutzpah to accuse President Trump of lacking a grip on reality.

WHOOPS: Top Economist Decimates Lefty Media ‘Recession’ Fearmongering

For all the media and lefty expert bluster about how President Donald Trump was supposedly steering the U.S. economy into a recession iceberg, none of it materialized. And one top economist is finally admitting the obvious: The Trump economy is strong, and its obsessive detractors have been dead wrong.