Video

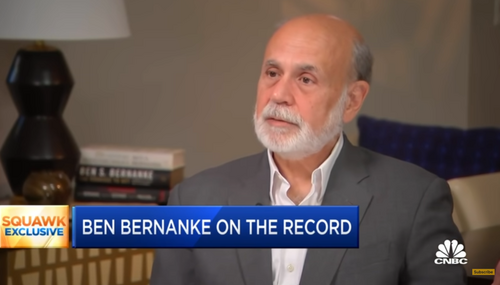

Former Fed Chair Bernanke Runs Cover for Biden on Inflation Crisis

Business

June 14th, 2022 5:04 PM

A former Federal Reserve chairman who dismissed concerns about the 2000s housing bubble attempted to squash fears of a 1970s-style inflation crisis under President Joe Biden.

Crickets: Fed Official Finds No Evidence That QE Accomplished Anything

August 20th, 2015 10:26 AM

Imagine if, in 1987, a Federal Reserve official could have pointed to a poorly performing economy and said, "Gee, this supply-side economics hasn't worked out very well." The press would surely have treated the story as a front-page item and ensured that it got air time on the Big Three networks' then-dominant nightly news broadcasts. Of course, there was no such credible report, because the…

AP: Reducing Fed's Annual 'Stimulus' From $1.02 Trillion to $900 Bil I

December 19th, 2013 11:25 PM

As would be expected, Associated Press reporter Martin Crutsinger Wednesday treated Federal Reserve Chairman Ben Bernanke's announcement that the nation's central bank will reduce the amount of money it creates out of thin air from $1.02 trillion per year to $900 billion, i.e., from $85 a month to $75 billion, as "its strongest signal of confidence in the U.S. economy since the Great Recession…

Greenspan: ‘Government Intervention Has Been So Horrendous' Business

December 8th, 2013 11:42 AM

Former Federal Reserve Chairman Alan Greenspan made some rather ominous economic observations Sunday.

Appearing on CNN’s Fareed Zakaria GPS, Greenspan said, “[T]he level of uncertainty about the very long-term future is far greater than at any time I particularly remember.” He blamed it on “government intervention [that] has been so horrendous that businesses cannot basically decide what to…

CBS, ABC Positive About Economy Nearly 2-to-1; Fed Disagrees

September 25th, 2013 10:26 AM

So much for the recovery. Even liberals admit employment is “weak,” that household wealth hasn’t recovered and consumer experts say middle-class retailers are “struggling.” But two of the three broadcast news networks have been much more focused on “proof that the economy is getting stronger,” than on economic worries since the May jobs report was released June 6.

Fed Reserve Official Notes Negligible Economic Boost from QE2; Establi

August 19th, 2013 10:07 AM

A November 15, 2010 blog post by Michael S. Derby at the Wall Street Journal ("San Francisco Fed Official Says QE2 Is Working") told us that "The Federal Reserve‘s recently announced plan to buy $600 billion in Treasury securities to improve economic growth is having a positive effect on growth." The Fed official involved also predicted "the U.S. gross domestic product to come in at 2.5% this…

Bernanke's 'If We Were to Tighten, the Economy Would Tank' Comment Ign

July 17th, 2013 11:27 PM

Today, as the wire service AFP reported in a story carried at Yahoo.com, Federal Reserve Chairman Ben Bernanke, in the question and answer exchange after his prepared testimony, told the House Financial Services Committee that "If we were to tighten (monetary) policy, the economy would tank."

That assessment of the economy's fragility qualifies as news, especially given the Obama…

CNBC’s Jim Cramer: Obama’s Sequester Fearmongering Caused Hiring S

April 7th, 2013 2:04 PM

CNBC’s Jim Cramer made a statement on NBC’s Meet the Press Sunday that likely shocked the host as well as the other liberal media members involved in the discussion.

After David Gregory mentioned Friday’s lousy unemployment report, Cramer said, “This is stunning. Stunning. And I think a lot of it had to do with fearmongering” (video follows with transcribed highlights and commentary):

Liberal Economist Takes On Krugman: Federal Reserve Averted Depression

March 11th, 2013 9:29 AM

While you were watching Rand Paul's historic filibuster and the debate surrounding budget sequestration, an economic theory battle was waging between two of the nation's foremost liberal economists Paul Krugman and Jeffrey Sachs.

In his most recent salvo published at the Huffington Post Saturday, Sachs spoke heresy to Obama-lovers across the fruited plain including Krugman claiming that…

CBS's Dickerson Boasts Obama 'Has More Leverage' If Country Goes Off F

November 21st, 2012 4:02 PM

CBS News political director John Dickerson all but crossed his fingers on Wednesday's CBS This Morning as he forwarded the idea of letting the country go over the looming fiscal cliff so President Obama could gain the political advantage: "There is an argument for actually...letting this happen. The President gets even more leverage."

Dickerson explained that "if the so-called fiscal cliff…

Undisclosed 'Former' Dem Operative Posts at WaPo on How 'Welcome For S

September 18th, 2012 4:02 PM

BizzyBlog and NewsBusters commenter dscott brought an item at a Washington Post business blog to my attention earlier today.

Entitled "Fed action a welcome move for small businesses" and appearing very early this morning, it claims that Federal Reserve Chairman Ben Bernanke's third round of quantitative easing, aka QE3, is "confidence-building move" and "a reassuring sign to the financial…

AP Seems Stunned That Yesterday's Auction of 'Ultra-safe' Treasuries D

September 13th, 2012 12:20 PM

Whoever wrote the Associated Press's brief dispatch yesterday on the results of the government's auction of 10-year Treasury notes seemed to be stunned and on the defensive about its result.

The item, entitled "Weak Demand at Auction of 10-Year U.S. Treasury Debt," began as follows: "U.S. Treasury prices dived Wednesday after an auction of 10-year notes drew very weak demand, signaling a lack…

Bernanke Claims Two Rounds of QE Created 2 Million Jobs; That Would Me

August 31st, 2012 11:53 PM

In his Jackson Hole, Wyoming presentation today, Federal Reserve Chairman Ben Bernanke, as reported by Paul Wiseman at the Associated Press, made the following claim in connection with the Fed's programs of "quantitative easing" (QE): "Bernanke argued Friday that collectively, such measures have succeeded. He cited research showing that two rounds of QE (quantitative easing) had created 2…

Paul Krugman Wants to Replace Ben Bernanke as Federal Reserve Chairman

July 28th, 2012 3:11 PM

Here’s a really scary thought: New York Times columnist Paul Krugman wants to replace Ben Bernanke as the Chairman of the Federal Reserve.

The perilously liberal economist actually said this in a segment of CNN’s Fareed Zakaria GPS to be aired Sunday (video follows with transcribed highlights and commentary):