On Wednesday, President Trump announced alongside rapper Nicki Minaj the creation of “Trump Accounts” of $1,000 each for any American child born between last year on January 1, 2025 and December 31, 2028 to grow until they’re 18 years old. With the ability for parents and businesses to contribute, it could reach upwards of $300,000. Between Wednesday night and Thursday morning, NBC didn’t see as reason to cover it on NBC Nightly News and Today.

On Wednesday, President Trump announced alongside rapper Nicki Minaj the creation of “Trump Accounts” of $1,000 each for any American child born between last year on January 1, 2025 and December 31, 2028 to grow until they’re 18 years old. With the ability for parents and businesses to contribute, it could reach upwards of $300,000. Between Wednesday night and Thursday morning, NBC didn’t see as reason to cover it on NBC Nightly News and Today.

Worse yet, ABC skipped it on World News Tonight only to bring it up on Good Morning America in order to scoff at its potential and imply it’s not particularly worthwhile unless you’re extremely wealthy.

Co-host Michael Strahan teased it twice and, on both occasions, kept it vague by promising to share “what we know about how it will work” and then “the latest on what the President is urging new parents to opt into for their babies and what he’s promising.”

In the second hour, senior White House correspondent Selina Wang had the story and briefly explained how setting one up will work (fill out IRS form 4547) and that “[p]arents can also add their own money up to $5,000 a year, but it has to be invested in a broad stock market fund like S&P 500 and you cannot withdraw it until your child turns 18.”

After adding major employers have already stepped up to contribute, Wang proceeded to turn it around and cast doubt on its effectiveness:

Now, critics say the accounts mostly benefit wealthier families who can afford to contribute more and they point out the tax benefits are actually less generous than existing options like 529 college savings plans and Roth IRAs. And, guys, all of this coming as Trump faces growing pressure to address affordability with new polls showing most Americans disapprove of how he’s been handling the economy, guys.

Increasingly prone to offer snide, partisan asides like fellow co-host George Stephanopoulos, Strahan huffed afterward: “So, if you’re considering this, Selina, make sure you weigh all your options.”

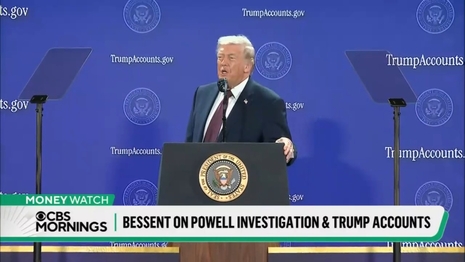

While they’re still offering heapings of liberal, anti-Trump drivel, the Bari Weiss-led CBS News covered it in full with relatively positive, nuanced segments on Wednesday’s CBS Evening News and Thursday’s CBS Mornings.

On the former, anchor Tony Dokoupil set up MoneyWatch correspondent and CBS Saturday Morning co-host Kelly O’Grady: “President Trump, meanwhile, is celebrating what he calls one of the most transformative policies of all time, a new so-called Trump Account for kids with the U.S. government chipping in the first $1,000. What you need to know now from Kelly O’Grady.”

Here is a CBS News segment that left is NOT going to like — Wednesday’s ‘CBS Evening News with Tony Dokoupil’ had a relatively positive, straightforward story about the #TrumpAccounts and part of an interview with Kelly O’Grady and Treasury Secretary Bessent pic.twitter.com/xoh7uqTTUp

— Curtis Houck (@CurtisHouck) January 29, 2026

“Today, President Trump touted his new Trump accounts, designed to grow a nest egg for young Americans,” she began, segueing into a Trump soundbite declaring he’ll be “giv[ing] newborn American child a financial stake in the future.”

O’Grady, who went down to Washington to cover the announcement, also interviewed Treasury Secretary Scott Bessent.

In between soundbites, she explained more of how it’ll work. At one point in the back and forth, she pressed Bessent to explain how these accounts will “prevent the wealth gap from widening.” Take notice of Bessent’s answer about financial literacy (click “expand”):

O’GRADY: When filing taxes, parents with an American child under 18 can opt in to opening a Trump account, a tax-deferred investment account. We sat down with Treasury Secretary Scott Bessent. [TO BESSENT] What, for families viewing, is your one-sentence pitch on the Trump accounts?

TREASURY SECRETARY SCOTT BESSENT: Well, for the families who have children between January 1st, 2025 and December 31, 2028, you’ve got $1,000 coming from the government that’s going to be invested into an index fund.

O’GRADY: Michael and Susan Dell and other philanthropists have also pledged donations that they can specify for certain groups, while parents, employers, and non-profits can make contributions in any Trump account up to five grand annually. If the government’s initial $1,000 deposit is left alone, it could grow to $5,800 in 18 years. If you contribute the maximum each year, it could grow to over $300,000.

O’GRADY [TO BESSENT]: How are you going to prevent the wealth gap from widening with this program?

BESSENT: Well, I think that that is a terrible criticism. It shows how out of touch anyone who says that is, because if they say only $5,000, these are families, huge number of families in America, wouldn’t have $500 to meet their medical emergency.

O’GRADY: Secretary Bessent hopes these accounts will improve financial literacy.

BESSENT: 38 percent of the households who don’t have stocks, Wall Street is this abstract notion. All of a sudden, they have participated for 18 years that in the financial markets. So, it’s a constant financial education.

O’Grady again presented the so-called opposing view while back on-screen: “Tony, the pushback from critics is that without significant investment, the biggest benefits are still out of reach for most. By the way, major companies like Visa, Chase, Bank of America have all signed on to contribute[.]”

She returned for Thursday’s CBS Mornings and, after airing the same portion of her Bessent interview, CBS News business analyst Jill Schlesinger joined O’Grady to provide her own takeaway.

Schlesinger — whom one could view as the Jan Crawford of financial news — laid out the positives, the negatives (i.e. why other accounts might be better), and her personal opinion to take the money (click “expand”):

This is a really balanced, well-done segment about #TrumpAccounts on Thursday’s ‘CBS Mornings’ with @TheKellyOGrady and @JillOnMoney Schlesinger.

— Curtis Houck (@CurtisHouck) January 29, 2026

Benefits, drawbacks, reminder about 529s, and why you should still take the money b/c, well, $1,000 is better than $0. pic.twitter.com/l44oZRtcQa

O’GRADY: So you just heard the Treasury secretary talk about, what is your read on what parents need to know and how it is going to work?

SCHLESINGER: If you had a baby the last year and you’re going to have one in the next three years, take the $1,000. This is fantastic. I mean, it is free money.

O’GRADY: Something is better than nothing?

SCHLESINGER: Absolutely. And what we know is the money grows without any taxation. So, you know if you have money in the bank and you have an interest payment, that’s taxable. These accounts are not taxable until you take the money out or until the beneficiary does. So, you know, it’s very interesting to me that there’s a way to have this money growth — think of it more like your kid’s account as if it were an IRA. Hasn’t been taxed yet. When you do, the tax is due, whatever the tax bracket of the kid. So, this is all good news. It may not be a game changer, but something’s better than nothing.

O’GRADY: We hear a lot about the 529. Compare this.

SCHLESINGER: Well, this is really a little bit more flexible in some ways, but if you are saving for education or maybe potentially for little retirement, I much prefer the 529.

O’GRADY: Okay.

SCHLESINGER: First of all, the money that goes into the 529, you don’t get a deduction federally, but basically some states are giving you state income tax deduction and that’s great. The money grows without taxation. When you take it out for education, whether it is secondary school or college, no tax due at all, so it makes it a much better plan. And, also, any unused 529 plans can be rolled into a Roth IRA for the beneficiary up to $35,000. I think the 529 is a little stronger of a vehicle if you are putting money in yourself. Again, the $1,000 from the government is great. Before you put your contribution into that new account I would look at the 529.

O’GRADY: Yeah, I think that’s a helpful comparison.

To see the relevant transcripts from January 28 and 29, click here (for the CBS Evening News), here (for ABC’s Good Morning America), and here (for CBS Mornings).