Kimmel, Newsom Denounce 'California Derangement Syndrome'

California Gov. Gavin Newsom joined ABC’s Jimmy Kimmel on Tuesday for what felt like preparation for a 2028 presidential bid. Both men denounced what they called “California Derangement Syndrome," and despite Newsom comparing himself to PolitiFact, Kimmel did not fact-check him when he told a pants-on-fire falsehood about California’s taxes.

WOW: Washington Post Skewers Nutty Bernie Sanders Wealth Tax Proposal

The Washington Post editorial board shocked the internet by vigorously thwacking the nutty socialist tax proposals by one of the left’s most radical icons in Congress: Sen. Bernie Sanders (I-VT).

HA! CNN Admits ‘Trump Is Right: The Economy Is Strong’ Post-SOTU

It’s been proven that CNN will never give President Donald Trump an inch on a “strong” economy without taking logic and twisting it into such an amorphous pretzel to take nonsensical jabs at his record anyway.

STUNNER: CNN’s Fareed Zakaria Rips Fiscally Out of Control Blue Cities

One of CNN’s most notorious TV egoists surprises viewers every once in awhile by displaying a modicum of common sense in the face of leftist politicians running economies into the mud. His recent repudiation of blue city spending is no exception.

Bad Investment? Lefty Billionaire Spielberg Flees High-Tax California

One of California governor Gavin Newsom’s (D) most high-profile donors is getting the heck out of Dodge. Steven Spielberg, one of the most influential movie-makers in Hollywood history, is reportedly fleeing California for New York, according to the New York Post.

Wall St. Journal Columnist Rails Against Billionaires Evading Taxes

The Wall Street Journal has promoted itself as the "Daily Diary of the American Dream," as a promoter of national prosperity. But some columnists find the titans of capitalism too unseemly to support any more.

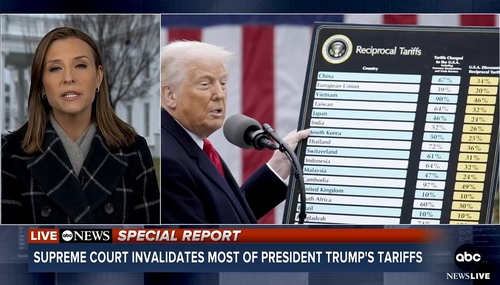

ABC Trumpets ‘Devastating’ Blow to Trump in SCOTUS Case on Tariffs

All the major broadcast networks — ABC, CBS, and NBC — broke in Friday morning with special reports on the Supreme Court’s 6-to-3 ruling declaring most of President Trump’s landmark tariffs unconstitutional. Unsurprisingly, ABC was almost ebullient in touting the ruling as “devastating,” “huge,” and “monumental” in hampering Trump’s presidency.

NY Times Keeps Trying to Yank a Win from Failed Tariff Doom Forecasts

The New York Times just can’t seem to get a grip on the fact that its fearmongering that economic catastrophe was nigh due to the Trump tariffs over the past year never materialized.

Americans Vote With Their Feet

It may seem that it’s impossible to get anything done in Washington these days. Nevertheless, the free spirit of Americans cannot be suppressed. Americans are voting with their feet. Per the Census Bureau’s just released annual report on population growth and migration in the U.S., Americans are packing up and moving from anti-growth blue states to pro-growth red states.

Va. Dems Seek to More than Double Their Pay - While Imposing New Taxes

After campaigning on “affordability,” Virginia state Democrats have introduced a measure to more than double their salaries, now that fellow Democrat Abigail Spanberger is in the Governor’s Mansion, giving them control of all three branches of their state’s government.

NYT: 'Economic Toll Of Trump Era' Delayed, but We Swear It’s Coming!

The New York Times will never admit that it completely botched its crystal ball readings on the so-called impending doom of the Trump economy. Instead, the Old Gray Lady will just keep kicking the can down the road indefinitely in the hopes that it will eventually be right.

NUT: Krugman Tells Businesses to Cut Ties with Trump or ‘You'll Hang'

The bitter ex-New York Times columnist Paul Krugman went to a new level of deranged by using the poorest choice of words to describe his disdain for corporate America’s relationship with President Donald Trump.

Pin the Tail on the Jackass: CNBC Blames Biden for Affordability Issue

It’s always great TV when the business journos over at CNBC take a wrecking ball to the media’s never-ending croaking against the Trump administration for an affordability issue they pretended wasn’t such a big deal under its predecessor.