OOPS! Axios Just Kneecapped the Media’s ‘K-Shaped Economy’ Narrative

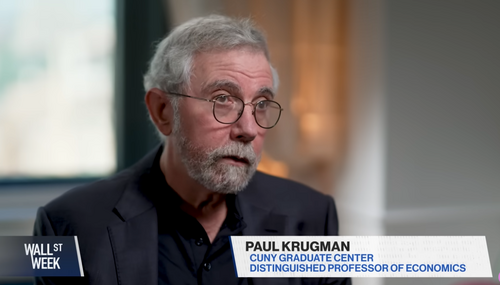

One of the most exhausted methods employed by the media to tear into the Trump economy has been to whip out the narrative that it is “K-shaped” -- wealthy Americans propping up consumer spending while poorer consumers increasingly pull back. But a new report from Axios just blew up that whole talking point.

WATCH: Goldman Sachs CEO Bucks Media with Upbeat 2026 Economic Outlook

Last Friday on CNBC’s Squawk Box, the CEO of Goldman Sachs blew a gaping hole in the never-ending media outrage bait about the Trump economy. Asked by co-host Joe Kernen for his 2026 economic forecast, David Solomon emphatically replied that “the macro setup is quite good,” which shatters doom narratives being promulgated by CNN, The New York Times, and others desperate to…

Here’s 50K Reasons Why Not to Take CNN’s Stock Market Calls Seriously

Nearly a year has passed and the stock market catastrophe that CNN was predicting was just on the horizon because of President Donald Trump’s tariffs still never materialized.

CNN's Brain-Dead Take: Trump ‘Might Regret’ Refocusing on Economy

President Donald Trump is making a huge mistake campaigning on an economy that’s projected to have expanded well over four percent at least in Q4 2025 didn’t ya know! At least, that’s the newest hot take being blurted into cyberspace by CNN.

CNN Contradiction: Trump Agenda ‘Could Work’ But Will Hurt Americans!

Reading CNN’s ridiculous hot takes on the Trump economy is enough to knock a few points off your intelligence quotient. Its TDS-afflicted reporters consistently behave as if writing in contradiction just to sour public opinion doesn’t affect the credibility of their arguments.

NYT: 'Economic Toll Of Trump Era' Delayed, but We Swear It’s Coming!

The New York Times will never admit that it completely botched its crystal ball readings on the so-called impending doom of the Trump economy. Instead, the Old Gray Lady will just keep kicking the can down the road indefinitely in the hopes that it will eventually be right.

Tough Noogies, Naysayers: CNN’s Scott Jennings Defends Trump’s Tariffs

While the leftist media scramble to retain whatever illusory credibility they think they have over their eroding predictions of a Trumpian economic disaster, CNN’s tour de force Scott Jennings took to ABC’s This Week to list off some of the president’s W’s.

EXCLUSIVE: Apple Bank CEO Explores State of U.S. Capitalism with MRC

Steven C. Bush, chairman, president, and CEO of Apple Bank— the largest state-chartered savings bank in New York state — spoke with MRC Business about his optimism for the future of American capitalism amid troubling trends.

Axios Admits Trump Economy One of the Better Economies of Modern Times

Axios perhaps just inadvertently committed one of the most based forms of narrative-wrecking journalism ever to hit the leftist media ecosphere by admitting the Trump economy is a lot better than what the propaganda suggests.

CNN Gobsmacked: Trump’s Economy Keeps Defying Doom Coverage

Following the gangbusters’ September jobs report that vastly eclipsed expectations, CNN hacks are now awkwardly doing the Watusi dance to try and explain around why the Trump economy isn’t the disaster they said it was.

MEDIA FAIL: American Jobs Growth Explodes by 119,000 in September

For all the media brouhaha about how the jobs market under Trump was going down the toilet, new government data — AGAIN — blew the fear-mongering to smithereens.

Two-Faced AP Claims Trump May Be ‘Face of Economic Discontent’

The Associated Press is doing its utmost to cast President Donald Trump as the bogeyman of America’s economic woes, despite having a sordid record of carrying water for the Bidenomics policies that put us in this mess to begin with.

Okay, Doomers: MSNBC Prophesizes Trump Economy Heading for 1929 Crash

Despite all the media pseudo savants’s end-of-the-world predictions about the Trump economy falling flat on their faces, MSNBC is still out there banging pots and pans over an incoming Great Depression-era crash.