Rahm Emanuel Sounding Like a Republican

Rahm Emanuel wants to take leadership of the Democratic Party and capture its nomination for president in 2028. He shares his thoughts in a recent Wall Street Journal op-ed. It’s the first time a Democrat has made me smile since President Bill Clinton announced in his 1996 State of the Union address that “The era of big government is over.” Emanuel has a stellar political resume that…

CNN’s Complete Narrative Flip-Flop on Federal Shutdowns Is SHAMELESS

CNN senior reporter Matt Egan stepped in it again by completely upending the narrative his network has been selling to Americans for years that a government shutdown would be disastrous for the economy.

VIDEO: Young Turks’ Ana Kasparian Fails Math BIGLY on CNN

The Young Turks co-host Ana Kasparian made a complete fool of herself when she let one of her anti-Israel brain drain episodes affect her so much she tried to convince the world America spends more on Israel than Social Security.

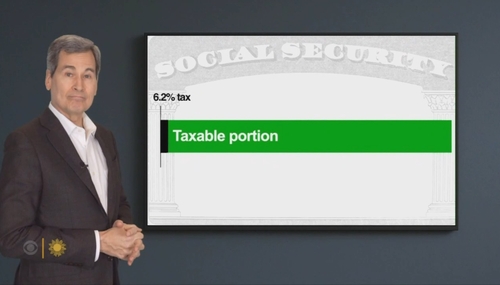

CBS Discovers Social Security Time Bomb, Pushes More Taxes as Best Fix

Entitlement spending was the largest driver of America’s debt and the Social Security time bomb had been counting down for decades. Over the weekend, CBS News Sunday Morning stirred at the sound only to promote raising taxes as the most viable solution, dismissed investing the money, and completely ignored President Trump’s baby bonds which were already signed into law last month. Of…

Larry Summers Loses Noggin Nuggets Over Trump’s ‘2,000 Days of Death’

Former President Barack Obama’s National Economic Council director has slipped from being the voice of reason on inflation to going full Cocaine Bear by screeching that President Trump was killing people with his economic agenda.

How About Them Apples: CBS Discovers Social Security Is Going Broke

On Thursday, CBS showed some admirable news judgment on CBS Mornings and the CBS Evening News by choosing to inform viewers about a ticking fiscal bomb many fiscal hawks have been warning about for decades, which is Social Security essentially going broke in the next decade. Even though it’s being talked about as a Republican is in the White House, it’s still worth giving…

ABC, NBC Trumpet Sleepy Joe’s First Post-Office Speech Bashing Trump

Even though it’s doubtful the liberal base or even establishment asked for it, former President Joe Biden gave his first speech Tuesday night since leaving the White House and, given the depths of their hatred for President Trump, ABC and NBC sang Biden’s praises for “sounding the alarm about how divided the nation is” and “defend[ing] Social Security.”

Fix Social Security With American Principles — Ownership

The speed and seriousness with which Donald Trump is shaking up Washington has everyone’s head spinning. If the president called me and asked my advice how he should explain to the American people what he is doing, I would say he should tell every American to read our Declaration of Independence. Donald Trump is working to restore the principles and foundations that the nation’s founders…

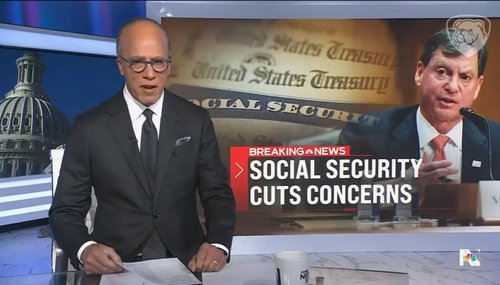

NBC’s Social Security Fearmongering Pushes Grandma Off a Cliff

Tonight’s NBC Nightly News reporting on the Senate hearing to confirm business executive Frank Bisignano as head of the Social Security Administration had a familiar sound to it. If you listen closely enough, you’ll hear the kind of fearmongering that was a staple of a bygone era.

PolitiFact: Musk 'False' For Social Security-Ponzi Scheme Comparison

PolitiFact’s Louis Jacobson slapped a “false” label on Elon Musk on Wednesday for his claim that Social Security is a Ponzi scheme. Jacobson’s big argument against Musk was not convincing, as he insisted that because Social Security is legal, it can’t be accurately described as a Ponzi scheme.

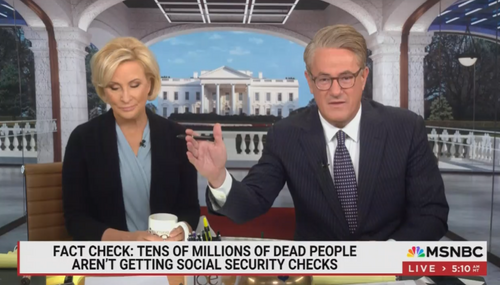

Joe AND Mika Lied on Musk Aim to 'Eliminate' Social Security, Medicare

The blowhards at MSNBC’s Morning Joe should realize that continuing to shoot lies through their whitened tooth implants on the air about Elon Musk doesn’t make them any more true. What’s worse is that they don’t even attempt to be clever about it.

Leavitt Praises WashPost Changes, Battles AP, CNN, Politico on Tariffs

On Tuesday’s installment of the White House press briefing, Press Secretary Karoline Leavitt praised the changes owner Jeff Bezos is making at The Washington Post, gave the “new media” seat to Saagar Enjeti of Breaking Points, and faced tough questions from across the spectrum on the economy from Fox News, CNN, Politico, and even the Associated Press.

Elon Musk Should Take on Social Security

If I say that Elon Musk is the smartest, boldest, most creative entrepreneur in the world, I don’t think I will get pushback. President Donald Trump’s move to bring him to Washington and put him at the top of a new Department of Government Efficiency, DOGE, to do the seemingly impossible -- to streamline a vastly outsized government spending behemoth -- injects hope that yes, maybe there is…

'The Building Always Wins'—Kasie Hunt's Synonym For 'The Deep State'

Liberals often deny the existence of the Deep State, as exemplified by a column by David Remnick, editor of the New Yorker: "There Is No Deep State." But on CNN This Morning, Kasie Hunt acknowledged something that is effectively a synonym for the Deep State. Describing the challenges facing Elon Musk and Vivek Ramaswamy in their DOGE undertaking to render the federal government more efficient…