Social Security

Nets All Over The Place On Trump-Biden Row Over Social Security

With the general election underway, the campaigns are off to the races…and so are the networks’ respective political correspondents. And they seem to be all over the place, as their coverage of reaction to remarks made by former President Donald Trump over the future of Social Security.

Social Security: A Broken Socialist Dinosaur

It seems many still harbor, or want to perpetuate, the illusion that our Social Security system is not in trouble. Let me quote here from a press release from the Social Security Administration released March 31, 2023: “The Social Security Board of Trustees today released its annual report on the financial status of the Social Security Trust Funds. The combined asset reserves of the Old-Age…

Bongino Warns of ‘Most Predictable Financial Apocalypse’ in History

Syndicated radio host Dan Bongino sounded the alarm on the looming disaster posed by America’s precarious economic situation.

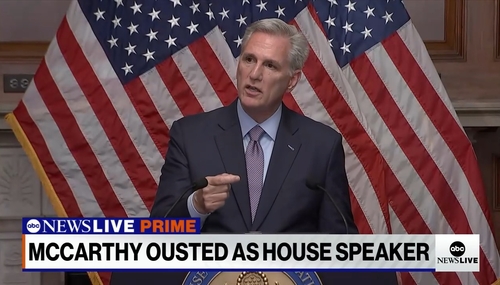

Entitlements, Spending Are the Real Problem (Not Kevin McCarthy)

Republican presidential candidate Nikki Haley got to the heart of the government shutdown fireworks in her appearance on Fox News Sunday. “Let's be clear what the Freedom Caucus is really trying to do; they are trying to cut spending.” That's of course correct. One would be hard-pressed to find any Republican, Freedom Caucus member or not, who does not understand the gravity of the state of…

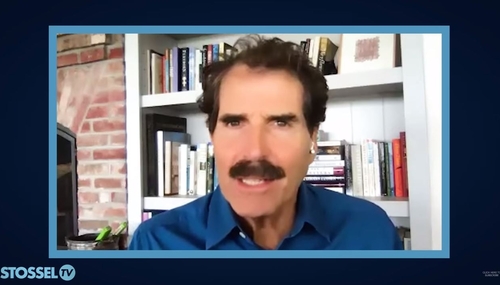

Budget Gimmicks: D.C. Labels Everything an ‘Emergency’ to Spend More

Did you survive the budget cuts from the last debt ceiling fight? President Joe Biden called them “draconian,” while Republicans praised the deal’s “historic reductions in spending.” But both parties conned us, as my new video explains. What they call “cuts” were just a reduction in their planned spending increase. Instead of raising spending by 7.8%, they increased it by “only” 3.9%. Only…

Ticking Time Bomb: Social Security & Medicare Are Broke

Social Security is toast. So is Medicare. Too many of us old people live longer, so there are not enough working people to support us. Soon both Social Security and Medicare will be broke. Our politicians don’t have the guts to do anything about it. Or even talk about it. It’s easy to see why. Recently, France’s president, trying to keep his country’s pension system from going broke, raised…

Our Fake Spending Debates

This week, Speaker of the House Kevin McCarthy, R-Calif., and President Joe Biden cut a deal to raise the debt limit. The breakthrough came after three months of Biden pledging not to even negotiate over the debt limit. Instead, Biden was forced to concede to a 1% cap on increases for non-military spending, a cutback on IRS funding, a clawback of some unspent COVID-19 allocations, and addition…

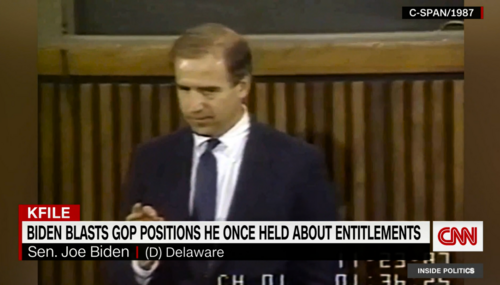

Oh My: CNN Reveals Biden Hypocrisy on Social Security and Entitlements

Is there an ulterior motive for CNN to suddenly criticize the political hypocrisy of Joe Biden.

'You Know Better,' Senator Calls Out CNN For Repeating Biden Spin

Louisiana Sen. Bill Cassidy is a man who does not concern himself with throwing red meat around, but even he ran out of patience with CNN’s Kaitlan Collins for repeating White House talking points about Republicans and Social Security, telling her that “you know better than that” during an interview on Thursday’s CNN This Morning.

Biden Claims GOP Wants to ‘Sunset’ Entitlements: What About His Party?

During President Joe Biden’s State of the Union speech, he got booed after accusing “some” Republicans of seeking to “sunset” some of the so-called entitlements[SP1]. Biden said: “Instead of making the wealthy pay their fair share, some Republicans ... want Medicare and Social Security to sunset. ... Anybody who doubts it, contact my office. I’ll give you a copy. I’ll give you a copy of the…

Obsessed: NBC’s Melvin Uses Interview to Pester Haley About Trump

2024 Republican presidential candidate Nikki Haley gave her first network interview to NBC’s Today co-host Craig Melvin for Thursday’s show and Melvin predictably made Donald Trump the focus, constantly pressing her on why she’d run against him, his role in January 6, his outlook on the 2020 election, his penchant for insults, and his views on foreign policy.

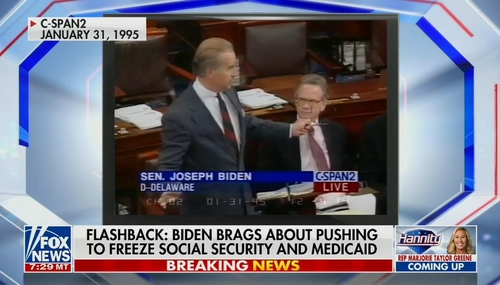

Politico Conveniently Overlooks Biden Urging Social Security Freeze

As Team Biden "keeps hammering Republicans" on modifying Social Security to restrain spending, Politico conveniently memory holed Joe Biden's past support for Social Security cuts while reporting on his attacks upon Republicans for wanting to make cuts to that program.

Colbert, Klain Boast Of Biden's 'Give 'Em Hell' SOTU

CBS host of The Late Show, Stephen Colbert may have had the week of the State of the Union address off, but that did not prevent him and former White House chief of staff Ron Klain from gloating over the moment where President Biden gave the false impression Republicans are demanding cuts to Social Security and Medicare on Monday’s show.