Stimulus

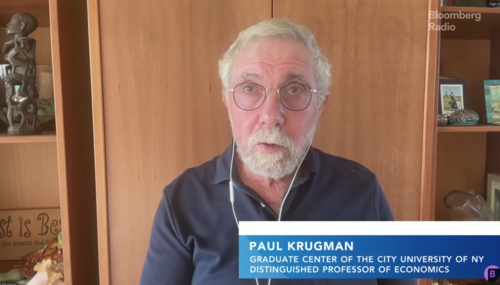

Krugman Claims Trump Will Worsen Housing Crisis Exacerbated by Biden

It’s pretty hilarious to read economic dunce-in-chief Paul Krugman squawk over President Donald Trump supposedly making a housing crisis that the columnist’s beloved Bidenomics drastically exacerbated in the first place, worse.

Living Under a Rock? WashPost CRIES Trump Politicizing Federal Reserve

Here’s a rule of thumb: Anybody who thinks that the Federal Reserve isn’t innately a political entity should have his head examined. But the collective of prefrontal cortex-challenged geniuses on The Washington Post editorial board are acting as if this politicization only started when President Donald Trump started putting pressure on Chairman Jerome Powell to lower interest rates.…

Larry Summers Loses Noggin Nuggets Over Trump’s ‘2,000 Days of Death’

Former President Barack Obama’s National Economic Council director has slipped from being the voice of reason on inflation to going full Cocaine Bear by screeching that President Trump was killing people with his economic agenda.

WHOA: Lefty FactCheck.org Actually Defends Trump’s First Term Economy

It must be a cold day in hell apparently. Leftist fact-checker FactCheck.org actually took time to defend President Donald Trump’s first term economy from deceptive falsehoods circulating online.

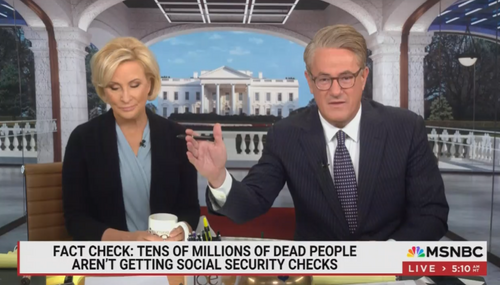

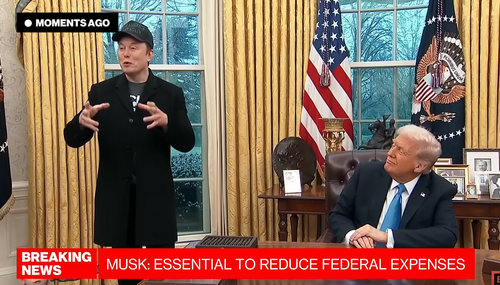

Joe AND Mika Lied on Musk Aim to 'Eliminate' Social Security, Medicare

The blowhards at MSNBC’s Morning Joe should realize that continuing to shoot lies through their whitened tooth implants on the air about Elon Musk doesn’t make them any more true. What’s worse is that they don’t even attempt to be clever about it.

ARE YOU HIGH? NY Times Claims Trump Ruining Biden’s 'Solid' Economy

It must have taken a hefty amount of acid dropping for the detached journos at The New York Times to psych themselves into believing the abject falsehood that President Joe Biden’s economy was just a booming spectacle of awesome.

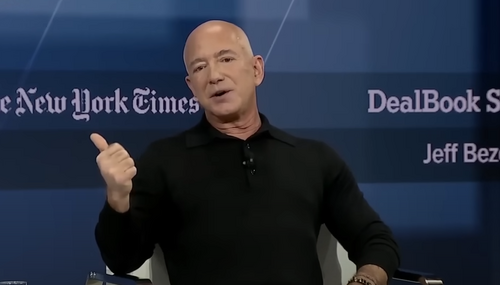

BASED: Jeff Bezos Orders Free Market Shift to WashPost Opinion Section

Washington Post owner Jeff Bezos announced a dramatic ideological shift for his newspaper’s opinion section toward free markets, and staff are predictably having a nervous breakdown over it.

WATCH: O’Leary Slaps Down Lefties Blowing a Gasket Over Elon Musk

Shark Tank star Kevin O’Leary — aka “Mr. Wonderful” — took a blowtorch to CNN and other lefties experiencing a mental collapse over emails from Elon Musk’s DOGE to federal workers asking them to give an account of their work progress.

SUCK IT UP: NYT Finds 7 Former IRS Chiefs to Kvetch Over DOGE Cuts

The New York Times acted like getting former IRS commissioners to bellyache over President Donald Trump’s cuts to one of the most hated agencies in Washington was some kind of a flex.

Oh, So Now Axios Suggests the US Inflation Outlook Actually Sucks?

What a joke. The same outlet that tried to paint America’s inflation situation before the 2024 election as Yankee Doodle Dandy! is doing the backstroke now that Donald Trump is president.

Politico Calls Out Dems for ‘Dramatic Swerve’ on Economy to Get Trump

Politico either advertently or inadvertently just exposed the Democrats’ grotesque hypocrisy in trying to yoke President Donald Trump to the inflation-plagued economy that his predecessor's insane spending policies created.

EXCLUSIVE: Leftist Media Falsely Blamed Trump for Q4 GDP Slowdown

The media didn’t even wait for the first quarter of President Donald Trump’s second term to blame him for GDP events that transpired before he was even elected to office.

Nutsy CNN: Jury Is Out on If Spending Caused ‘Inflation — If At All’

CNN, to no one’s surprise, tried to play Gotcha! by claiming President Donald Trump was “bucking” his campaign promise to cut prices immediately upon taking office, and ended up making the network look more idiotic than it already does. That is a feat unto itself.