Americans Vote With Their Feet

It may seem that it’s impossible to get anything done in Washington these days. Nevertheless, the free spirit of Americans cannot be suppressed. Americans are voting with their feet. Per the Census Bureau’s just released annual report on population growth and migration in the U.S., Americans are packing up and moving from anti-growth blue states to pro-growth red states.

The Midterms: It’s Not About ‘Affordability’ — It’s About Trump Hatred

No, the midterms will not turn on the issue of “affordability.” If affordability truly were decisive, Republicans would easily retain the House and the Senate. Consider the economic backdrop. Gas prices are at a five-year low, with gas stations in several states selling a gallon of regular for under $2. Several times since Trump’s reelection, the stock market indexes have recorded all-time…

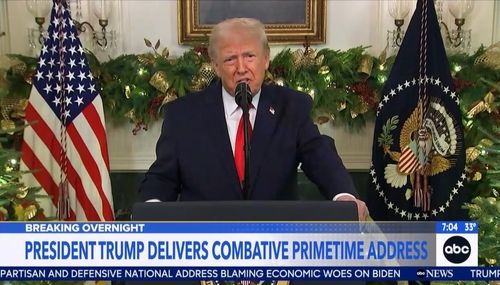

ABC RAGES Over ‘Combative,’ ‘Defensive,’ ‘Hyperpartisan’ Trump Speech

On Thursday, the broadcast networks led with President Trump’s Wednesday primetime address to the nation and all took great umbrage with his blaming of the Biden regime for the economy he inherited, but ABC’s Good Morning America was far and above the worst for its deep disgust over the “combative,” “defensive,” and “hyperpartisan” speech that ignored the “economic pain...under his…

Leavitt Puts CNN’s Collins on Blast Over Questions About the Economy

During a White House press briefing on Thursday dominated by questions about either the economy or Venezuela, Press Secretary Karoline Leavitt threw down with former conservative reporter-turned-liberal CNN host and chief White House correspondent Kaitlan Collins over the former topic with Collins insisting the state of the economy was not as strong as Leavitt made it seem and Leavitt hitting…

ABC Paints Trump Economy as in Turmoil, Slams ‘Vicious’ Jabs at Omar

While all three networks went hard in the paint Wednesday morning against President Trump and painted the economy as in turmoil, ABC’s Good Morning America was particular vicious with an entirely negative story and zero recognition of how economic indicators have improved vis-à-vis the Biden economy.

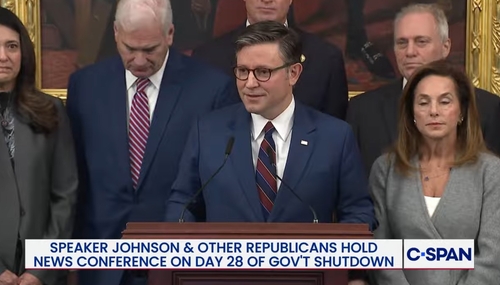

Last Thing on Democrats’ Agenda — Telling the Truth to Americans

Recently, in The Wall Street Journal, Neera Tanden, CEO of the Center for American Progress, a major foghorn in our nation’s capital for America’s left, explained “Why Democrats Won the Shutdown.” The most accurate declaration in the article is “fights tell the country a lot about what -- and who -- the fighters care about.” And, indeed, there should be no question what the Democratic…

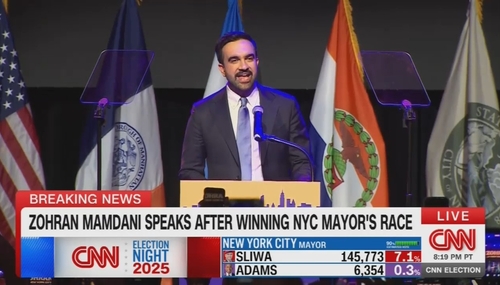

Mamdani’s Bad Ideas: Seizing Means of Production, Gov't Groceries

People are turning to socialism. Two-thirds of Americans ages 18-29 hold a “favorable view” of it. New York just elected a “proud socialist” mayor. My video explains why his ideas would make things worse. Of course they would! Socialism has never worked. Anywhere! Yet Seattle, too, just elected a socialist mayor. “Let’s give socialism a chance,” said a student writing in The…

Networks Celebrate ‘Earthquake’ Dem Wins, Predict Blue Wave in 2026

On Wednesday morning, ABC, CBS, and NBC were riding high and drunk on power after seeing their preferred candidates sweep with socialist Zohran Mamdani’s “astonishing surge” in New York City and Democrats Mikie Sherrill in New Jersey, and Abigail Spanberger in Virginia romping to huge wins, declaring this a GOP “bloodbath” and “glimmer of hope” for Democrats in 2026 with “a guidebook” to…

Hill Journos Tweet Twice as Many Johnson Jabs vs Shutdown Consequences

A NewsBusters analysis of five leading liberal Capitol Hill reporters has found that, by a margin of roughly two-and-a-half-to-one (72 to 28), they have taken to X more times since the start of the government shutdown to condemn Speaker Mike Johnson (R-LA) and the House for being out of session than they have highlighted crucial government programs like food stamps and pay for soldiers that…

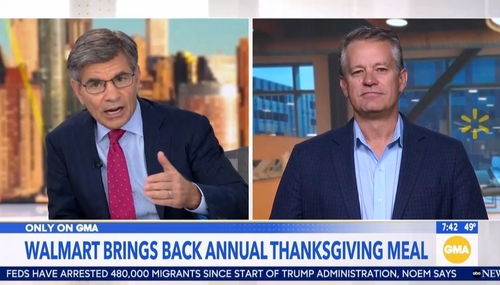

Stephanopoulos Thrice Fails to Have Walmart CEO Bash Trump Economy

ABC’s Good Morning America had an exclusive interview on Tuesday’s show with Walmart U.S. CEO John Furner about the upcoming Thanksgiving season and the overall state of the economy, but with co-host and former Clinton official George Stephanopoulos at the helm, it was framed as a hitjob on the Trump economy. Unfortunately for Stephanopoulos, Furner wasn’t having any of it.

Bigger Homes, Better Cars, Longer Lives: The Truth About Today

Have you heard how young people suffer now? Scroll TikTok, Instagram, etc., you see the same message: “Young people today can’t get ahead!” One popular meme says when baby boomers like me were young, “A family could own a home, a car and send their kids to college, all on one income.” “That’s a fantasy,” says economist Norbert Michel. “We are much better off than we were.” My new video takes…

Business Gets Back to Business

Over the years, our government has expanded dramatically, all with the objective of improving our lives. Yet, with all of this, confidence that Americans express in our country and its major institutions has plummeted. Of 18 of the nation’s major institutions, per a recent Gallup survey, there are only three in which 50% or more now express a “great deal or quite a lot” of confidence.

CBS’s Dickerson Dismisses Big, Beautiful Bill as DOOOOM for the Poor

The embodiment of the kind of acceptable liberal journalist to today’s left, CBS Evening News Plus has always ended with anchor John Dickerson let it rip on whatever issue he desires weighing in on. Increasingly, it’s been political and snide, giving his opinion on how much he loathes Trump and the MAGA agenda. Thursday was no exception as he denounced the Big, Beautiful Bill as…

One Hour of Evening Hate: CBS Goes All-in on Trump Bashing at Day 100

The liberal media greeted President Trump’s 100-day mark Tuesday with a torrent of negative coverage, so it was no surprise when CBS used both of its evening news shows — CBS Evening News and CBS Evening News Plus — to nearly go wall-to-wall in spewing disgust at the Trump administration, almost trying to conjure up a recession and economic ruin.