NY Times Keeps Trying to Yank a Win from Failed Tariff Doom Forecasts

The New York Times just can’t seem to get a grip on the fact that its fearmongering that economic catastrophe was nigh due to the Trump tariffs over the past year never materialized.

CNN's Brain-Dead Take: Trump ‘Might Regret’ Refocusing on Economy

President Donald Trump is making a huge mistake campaigning on an economy that’s projected to have expanded well over four percent at least in Q4 2025 didn’t ya know! At least, that’s the newest hot take being blurted into cyberspace by CNN.

Pin the Tail on the Jackass: CNBC Blames Biden for Affordability Issue

It’s always great TV when the business journos over at CNBC take a wrecking ball to the media’s never-ending croaking against the Trump administration for an affordability issue they pretended wasn’t such a big deal under its predecessor.

Google’s Non-Apology, and the West’s Digital ID Creep

Google's refusal to change its censorship policies has caught the attention of free speech advocates and politicians. In response to allegations of content moderation influenced by the U.S. government, Google offered no new admissions or changes. Meanwhile, debates over digital ID systems in the U.K. reveal concerns about privacy and control, with parallels drawn to potential U.S.…

CNN's Economic Hot Take So Dumb, Your Brain Might Go Bankrupt

The level of brain-dead sludge disguised as economic news just plastered on the CNN.com website just to slam the so-called Trump “threat” is enough to subtract ten points from your intelligence quotient.

CNN Legal Analyst Admits Trump May Have 'Cause' to Fire Fed Governor

Hell hath frozen over! A CNN legal analyst conceded President Donald Trump may have a legitimate case for firing Federal Reserve Governor Lisa Cook over mortgage fraud allegations — are pigs flying too?

MSNBC: 'Stability of Global Economy' Threatened If Lisa Cook Fired!

On MSNBC's The Weekend, co-host Jackie Alemany says, regarding the possible firing of Lisa Cook for having made false statements on multiple mortgage applications, "Not to be dramatic here, but it does sound like the potential stability of the global economy sort of hangs in the balance." One of Cook's lawyers, Norm Eisen, a guest on the show, declines to answer Alemany's simple question: "Did…

Surprise! Krugman Doesn’t Know Much About Federal Reserve Law Either

New York Times has-been Paul Krugman has enough trouble trying to sell his bona fides as a serious economist without making himself look more foolish mucking about with issues beyond his imaginary expertise. Federal law as it pertains to the president’s ability to fire Federal Reserve governors is no exception.

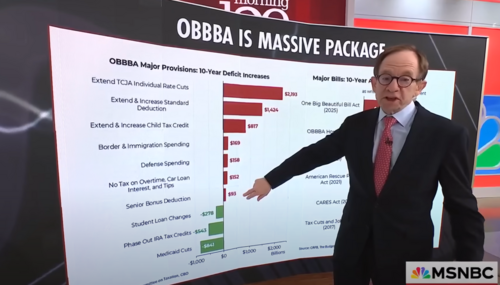

DUMB: MSNBC’s Rattner Compares Trump to China for Firing Fed Governor

Leave it to one of the clowns at MSNBC’s Morning Joe to compare President Donald Trump to the murderous Communist Chinese government because of his beef with the Federal Reserve.

Google Pushes Leftist Media Defense of Fed Gov that Trump Fired

Exclusive: Federal Reserve Gov. Lisa Cook may soon be out of a job following mortgage fraud accusations — but that has not stopped Google from propping up leftist sources in her defense, the Media Research Center can confirm.

THUNDER-LID: Abby Phillip Keeps ‘Maryland Dad’ Off NewsNight Table

In an interesting editorial choice, CNN NewsNight host Abby Phillip elected to keep credibly-accused human trafficker, wifebeater and MS-13 gangbanger Kilmar Abrego García off the table and away from any meaningful panel discussion. Phillip instead elected to do a brief blurb on Abrego García to close the show.

Living Under a Rock? WashPost CRIES Trump Politicizing Federal Reserve

Here’s a rule of thumb: Anybody who thinks that the Federal Reserve isn’t innately a political entity should have his head examined. But the collective of prefrontal cortex-challenged geniuses on The Washington Post editorial board are acting as if this politicization only started when President Donald Trump started putting pressure on Chairman Jerome Powell to lower interest rates.…

EXCLUSIVE: Leftist Media Falsely Blamed Trump for Q4 GDP Slowdown

The media didn’t even wait for the first quarter of President Donald Trump’s second term to blame him for GDP events that transpired before he was even elected to office.

Fireworks: CBS, Newsmax RIP WH for Hidin’ Biden With World Leaders

Thursday’s White House press briefing lacked some quality Doocy Time for the second day in a row, but there was still plenty of tense back-and-forths featuring Newsmax’s James Rosen, CBS’s Ed O’Keefe, and surprisingly the AP’s Zeke Miller over the Biden-Harris administration’s decision to hold this week’s Quad Summit — featuring leaders from Australia, India, and Japan — in Wilmington,…