Martin Crutsinger

AP Ignores All-Time Record Monthly Spending in Covering June Deficit

July 17th, 2017 8:30 AM

Records are supposed to be newsworthy, right? But in his Thursday coverage of the federal government's June Monthly Treasury statement, Associated Press reporter Martin Crutsinger only told readers that the deficit for the month was $90 billion. He did not disclose receipts or outlays. Why? Because if he had, he would have had to tell readers that the government spent an all-time record $429…

Press Fantasy: Trump Is Inheriting an Obama Economic 'Boom'

December 7th, 2016 11:54 PM

Readers who have spent any time reading economic dispatches from the establishment press since the presidential election have likely noticed that its business journalists have taken to praising the alleged wonders of the economy President Barack Obama is passing on to President-Elect Donald Trump. Current reality renders the praise completely undeserved, but of course that's not stopping them…

AP Ignores Health Spending Hikes, Finds New 'Strength' in the Economy

September 29th, 2016 2:36 PM

The government reported today that the US economy grew at an annual rate of 1.4 percent in the second quarter. That's a slight increase from the 1.1 percent reported a month ago, but certainly nothing to get excited about, especially given that annualized growth during the past three quarters has been barely above 1 percent. To make the Obama economy look better than it really is, the Associated…

AP's Opening Makes Awful Manufacturing Report Seem Positive

August 4th, 2016 11:42 PM

The press's reporting on the Obama era's awful economy has been nothing short of abysmal. Looking at the bigger picture on July 25, MRC Business's Julia Seymour named "6 key indicators of (a) weak economy" the press has glossed over or ignored since the recession ended seven years ago. The most obvious item she identified is the fact that the current alleged "recovery" is by far the worst since…

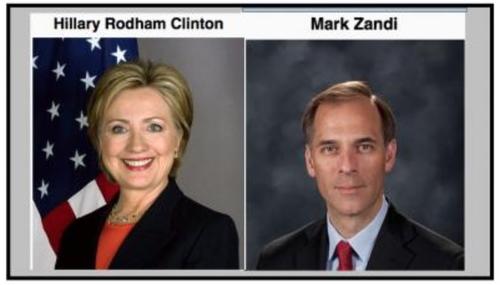

Hillary Donor Mark Zandi: Economy 'Resilient,' Job Market 'Incredible'

July 30th, 2016 6:52 PM

Yesterday's news about the economy was the latest in a 7-1/2 year series of mostly regular disappointments. The government reported that nation's Gross Domestic Product (GDP) grew at an annual rate of just 1.2 percent in the second quarter, half or less of what most alleged "experts" expected. Additionally, the first's quarter's originally reported 1.1 percent growth was revised down to 0.8…

Press Yawns as Federal Finances Deteriorate, Indicating a Slow Economy

July 13th, 2016 6:04 PM

It's a safe prediction that there will be renewed interest in the federal government's perilous financial situation if the country elects someone not named Hillary Clinton as its next president in November.

One reason why this prediction is so safe is how little interest there has been in even covering today's news about Uncle Sam's troubling June surplus of only $6.3 billion. The Associated…

Delusional AP Treats Awful Economic Report as ‘Rebound’

April 26th, 2016 12:33 PM

Today's stories at the business wires covering this morning's disastrous durable goods report from the Census Bureau ranged from good to absolutely horrid. March orders only increased by a seasonally adjusted 0.8 percent, less than half of the 1.7 percent to 2.0 percent increase that was expected. Additionally, February's originally reported decline of 2.8 percent was revised down to -3.1 percent…

Business Wires Trying to Spin Bad Numbers for Obama Administration?

April 19th, 2016 11:21 AM

The government reported this morning that seasonally adjusted March housing starts and building permits fell by 8.8 percent and 7.7 percent, respectively, far worse declines than analysts and economists predicted.

After the report, the business wires at least communicated the facts accurately, but continued to insist almost to the point of editorializing that there's no reason to be worried…

Press, Reacting to Dismal Consumer Spending News: Better Days Ahead

March 28th, 2016 1:39 PM

For the past month, the conventional wisdom about the U.S. economy has been that consumer spending and "(not really) robust" job growth will continue to prop up the economy, even as weaknesses in manufacturing, trade and other areas continue to present problems. President Obama bragged in early March that the economy is "pretty darned good now."

Today, the first of those two pillars got pulled.…

As Income Gains Almost Evaporate, AP Is Rooting For Higher Inflation

March 16th, 2016 11:51 PM

The government's Bureau of Labor Statistics reported today that consumer prices fell 0.2 percent in February.

Lower prices should be good news, right? Wrong, at least according to Martin Crutsinger at the Associated Press. Crutsinger's Wednesday dispatch also managed to ignore the fact that even the supposedly low inflation seen during the past 12 months has eaten up most of workers' very…

Not News: Economy's Wholesale Sales at a Four-Year Low

March 9th, 2016 4:11 PM

Actual sales at the wholesale level in January, as reported today by the Census Bureau, fell sharply from December. That's to be expected. But this time was different — really different, because the drop was to a level lower than January 2012, i.e., four years ago.

Four press outlets which covered today's release either missed (or ignored) this shocking news. They only told readers about what…

AP: U.S. Economy Started 2016 'With a Bang'

February 29th, 2016 2:07 PM

At the Associated Press, in a Friday morning writeup, the wire service's headline writers and reporter Martin Crutsinger demonstrated extraordinary auditory powers.

The headline writers somehow heard the entire U.S. economy start the year off "with a bang." Meanwhile, Crutsinger, continuing to earn his designated title of "worst economics writer" given by Kevin Williamson at National Review…

At AP, Economy's Good-News Story Sticks; Bad News Disappears (UPDATED)

February 23rd, 2016 5:43 PM

Two important economic reports came out today at 10 a.m. One had relatively good news, while the other was a definite downer.

At 2:43 p.m., the good-news item was still listed second at the Associated Press's list of Top 10 business stories, while the bad-news item was gone. That's all in a day's work of news manipulation at what should be called the Administration's Press. (UPDATE: At 9:12 p.m…

Yellen, AP Continue to Blame 'The World' As U.S. Economy Weakens

February 11th, 2016 5:28 PM

The Federal Reserve, Fed Chair Janet Yellen, and the ever-cooperative Associated Press have a message for America: "If there's an economic downturn, even one that turns into a recession, it's going to be the rest of the world's fault. The U.S. economy is fine, and it will stay fine if everybody else doesn't ruin it."

As the AP's Martin Crutsinger reported today ("YELLEN: TOO EARLY TO DETERMINE…