Taxes

A Taxing Time...at Tax Time

Was it as bad for you as it was for me? Sending Washington money we earn, but Washington doesn’t, I mean? It’s not just being part of half the nation that pays taxes while the other half doesn’t that bothers me. It’s the waste and unnecessary programs and agencies that have long outlived whatever usefulness they once had (if they were ever necessary). And still President Biden wants to raise…

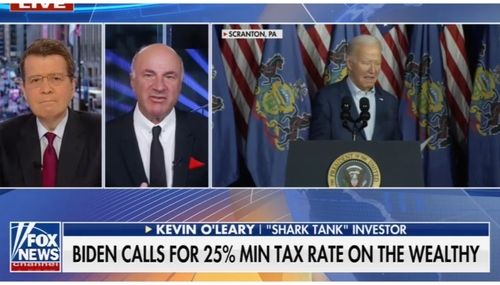

Kevin O’Leary: The More Biden ‘Taxes, the Less Growth There Will Be’

Shark Tank star Kevin O’Leary, aka “Mr. Wonderful” panned President Joe Biden’s new tax plan, suggesting that the president would damage the country in the same way that many Democrats have broken their states.

FLASHBACK: When a Juvenile News Media Tried to Destroy the Tea Party

Fifteen years ago this week, left-wing cable networks employed adolescent jokes to belittle the grass roots anti-Obama Tea Party movement, while the broadcast networks decried it as a front for “corporate interests.”

One More Try at Reducing the Debt

“Neither a borrower nor a lender be.”– Polonius to his son Laertes in “Hamlet” It may be too late given the number of Americans who have willingly allowed themselves to become dependent on government more than themselves, but it’s worth trying. Our $34 trillion debt is unsustainable, according to most economists. If we don’t act soon, we will be worse off than we are now. Our economy…

Charles Payne RIPS Biden’s Arrogant SOTU Claim

Fox Business host Charles Payne fired back at President Joe Biden for squandering America’s dominance on the global stage and then pontificating about his squalid economic record during the State of the Union address.

WHAT? WashPost Insanely Praises Immigration for ‘Roaring’ Economy

The Washington Post continues to outdo itself in generating downright idiotic takes to defend President Joe Biden’s trashy economic record, even if it means whitewashing the worsening border crisis.

MAKE IT MAKE SENSE: NYT Absurdly Claims Biden Economy ‘Looks Sunny'

The New York Times kicked its pro-Bidenomics Pravda into overdrive as the U.S. gears up for a contentious presidential election this year.

Uh, What? The Economist Praised Bidenomics as ‘Unfinished Revolution'

The Economist was either trying to have a good sense of humor or was really just dropping serious acid when it celebrated Bidenomics as basically an incomplete, pro-government stroke of genius that just needs four more years to be perfected.

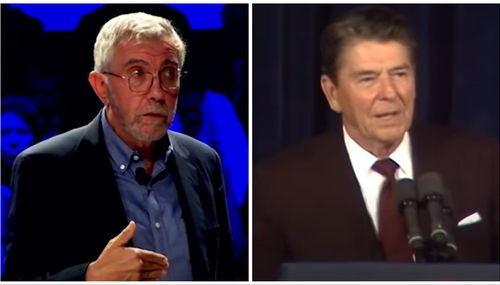

Paul Krugman Made to Look Like a Fool Comparing Biden to Reagan

The New York Times’ bumbling economics writer Paul Krugman continues to beclown himself the more he tries to defend the Bidenomics monstrosity.

EXCLUSIVE: Heritage Economist Rips Krugman’s Nutty Bidenomics Hot Take

It’s unclear anymore whether New York Times propagandist-in-chief Paul Krugman actually believes the pro-Bidenomics psycho-babble he spits out or if he’s just trolling at this point.

Simple Question: Are You a Maker or a Taker?

Politicians are often takers. They take our money (and freedom) in the name of achieving goals they rarely achieve. Elon Musk and Sen. Elizabeth Warren may be the best examples of maker and taker. They’re the stars of my video this week. Warren shouts, “Tax the rich!” She especially wants to tax Musk, the richest man in the world.

Stay Off the Weed! Columnist Claims ‘Bidenomics Beginning to Pay Off’

A columnist for The Observer apparently didn’t sense the comedic value in telling readers with a straight face that the clownish concept of Bidenomics is somehow finally starting to work.

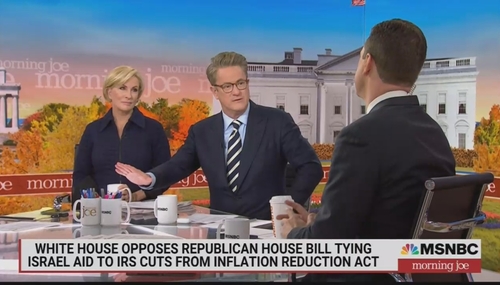

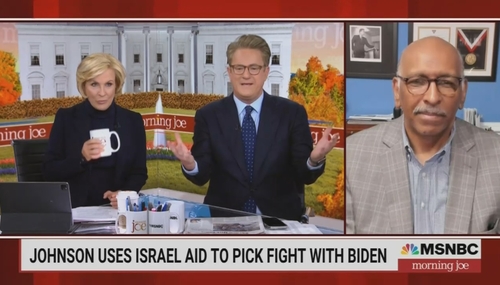

Scarborough: House GOP Favors Jew-Haters, Tax Cheats, Aliens & Putin

On Morning Joe, Joe Scarborough claims that "illegal immigrants," in addition to other reprobates like anti-Semites and Vladimir Putin, will like Speaker Mike Johnson's legislative proposal to fund aid to Israel without other spending items.

Sanders In Scarborough Halloween Outfit Proposing A 'Billionaire Tax?'

On Morning Joe, Joe Scarborough proposes a "billionaire tax" to fund the expansion of IRS audits. Although you might have thought it was Bernie Sanders or Elizabeth Warren in a Scarborough Halloween costume.