Oil & Gas Prices

Marc Morano Calls Out Biden for Hamstringing American Energy

Climate Depot founder Marc Morano spoke out against President Joe Biden’s decisions to slow down American energy production while potentially easing energy sanctions on the Islamic Republic of Iran.

‘Resign’: Hawley Bashes Infamous Biden Cabinet Official over Scandal

Senator Josh Hawley (R-MO) called for Biden administration Energy Secretary Jennifer Granholm to resign following a testy Senate hearing.

ABC Refuses to Ask Granholm About Corruption Allegations, Ties to EVs

Earlier this week, Energy Secretary Jennifer Granholm was grilled in a Senate hearing about allegations of corruption after it was discovered that she had financial ties to some of the very electric vehicle companies she was tasked with regulating and forcing Americans to eventually buy. But none of that was addressed by ABC News in an interview conducted by The View cast on Thursday…

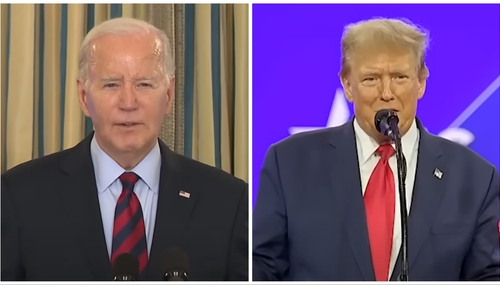

Ruhle Claims High Gas Prices Are a Russo-Saudi Plot to Elect Trump

With gas prices on the rise, MSNBC’s Stephanie Ruhle did what comes naturally to her: defending President Joe Biden. On Wednesday’s The 11th Hour Ruhle not only claimed that Biden has nothing to do with high gas prices, but he is being undermined by the Russians and the Saudis who are trying to get Donald Trump elected.

Networks Blame Middle East, Not Anti-Energy Biden for Gas Prices

ABC News Live and CBS Mornings absurdly ignored the impact of President Joe Biden’s anti-energy policies. At the same time, they blamed turmoil in the Middle East for present and even future energy prices.

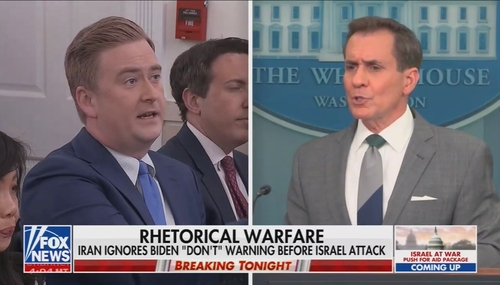

Doocy Triggers Kirby After Noting Biden’s ‘Don’t’ Plea to Iran FAILED

With President Biden on the road for the next few days, the White House press corps had to get their hardballs in while they could on Monday. Fox’s Peter Doocy, as always, had the adversarial questions the rest wouldn’t ask. This time, he went around and around with John Kirby over Iran predictably not being intimidated by President Biden’s simple demand to “don’t” fire missiles and drones at…

Paul Krugman Sleepwalked Into Another Unforced Error on Bidenomics

The New York Times economics parody writer Paul Krugman — because that’s all he’s been reduced to now — can’t seem to avoid sleepwalking his way into major, unforced errors.

Potpourri: Doocy Leaves KJP Fumbling While NPR Demands Israel Suffer

Given Wednesday’s White House press briefing ran less than 40 minutes, its abbreviated state largely made it uneventful aside from a truly comical Doocy Time having left the ever-inept Karine Jean-Pierre even more incoherent than usual and, on the other end of the spectrum, taxpayer-funded National Public Radio’s (NPR) Asma Khalid pled for Israel to suffer “consequences” for its war against…

Getting Gassy: CNN BEGS Readers ‘Don’t Panic’ About High Gas Prices

CNN is back to its old schtick of desperately spinning higher gas prices to look like no big deal for Americans, even though they’re currently hovering at four-month highs.

The New Yorker Wrote Mock State of the Union Speech to Sell Bidenomics

Apparently, The New Yorker isn’t confident President Joe Biden is capable of selling his atrocious economic policies on his own, so it has chosen to offer a propagandist’s helping hand by acting as his speech writer.

SHAME: WashPost Writer Twists Poll Data to Prop Up Biden Economy

The Washington Post economics columnist Catherine Rampell seemed to forget a rule of thumb when analyzing polls: read the crosstabs. Either that or she deliberately twisted data to make it seem like Americans are happier with President Joe Biden’s decrepit economy than they actually are.

ROUNDUP: Leftist Media Put Dizzying Spin on Hot Bidenflation Report

Consumer prices jumped hotter-than-expected, and leftist media outlets were predictably fumbling over themselves trying to spin the bad news in any which way they could to protect the floundering Biden economy.

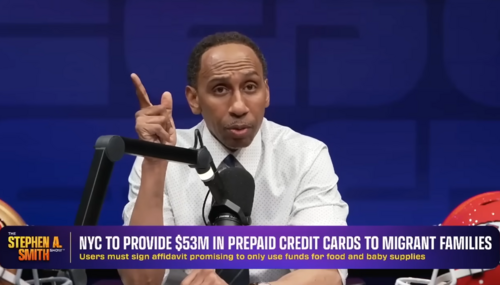

WHOA: Stephen A. Smith Rips Apart Dems’ Insane Economic Policies

ESPN First Take host Stephen A. Smith has had enough of the leftist economic policies exacerbating Americans’ struggles to stay afloat amidst high prices and an unsustainable cost of living crisis.