Economy

CBS Manages Story On Sticker Shock With No Mention of Inflation, Biden

There is a reason we call them Regime Media: their propensity to file stories that protect President Joe Biden from any scrutiny whatsoever, and absolve him from responsibility over the present-day calamities. Case in point: the latest CBS Weekend News report on high car and insurance prices.

Daily Show Tortures Pinata To Cope With Trump Leading Latino Vote

Actor and alleged comedian John Leguizamo joined Tuesday’s edition of The Daily Show on Comedy Central to have a calm and rational, adult-like reaction to polling that shows Donald Trump leading among Latinos. Just kidding, he decided to torture a piñata while going off a profanity-ridden Spanish tirade.

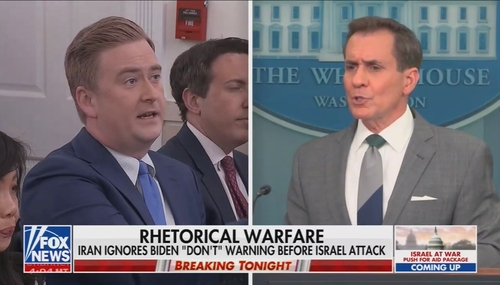

Doocy Triggers Kirby After Noting Biden’s ‘Don’t’ Plea to Iran FAILED

With President Biden on the road for the next few days, the White House press corps had to get their hardballs in while they could on Monday. Fox’s Peter Doocy, as always, had the adversarial questions the rest wouldn’t ask. This time, he went around and around with John Kirby over Iran predictably not being intimidated by President Biden’s simple demand to “don’t” fire missiles and drones at…

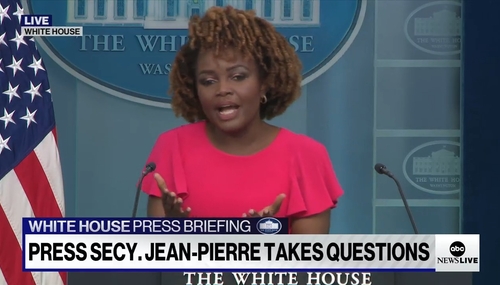

OUCH: KJP Gets Waxed by Fox’s Heinrich, Lawrence on the Economy

Press Secretary Karine Jean-Pierre went solo for Thursday’s White House press briefing, so she shouldered all the questions, including the Middle East and the economy. It was on this latter topic where she was put through the gauntlet by Fox News’s Jacqui Heinrich and Fox Business’s Edward Lawrence as they called out the administration’s channeling of Jim Carey in Dumb and Dumber in…

Paul Krugman Sleepwalked Into Another Unforced Error on Bidenomics

The New York Times economics parody writer Paul Krugman — because that’s all he’s been reduced to now — can’t seem to avoid sleepwalking his way into major, unforced errors.

Millionaire Whoopi Dismisses High Food Prices, Whines About Commute

ABC’s millionaire moderator, Whoopi Goldberg was in a foul mood during Thursday’s edition of The View because former White House Chief of Staff Ron Klain dared to say President Biden should focus his reelection message on issues that average Americans were concerned with such as inflation and high grocery prices. She repeatedly shouted down any attempt to suggest he had the power to…

NBCNN Laments Bad Inflation Report 'A Challenge' For Biden Campaign

The network evening newscasts did their best to bury yesterday’s bad inflation news. Literally. Both by leading their newscasts off with severe weather and by running their respective inflation items after the 10-minute mark.

6 Myths About Globalization, Trade, Jobs, and ‘Buy American’

Leaders of both parties agree: We must reduce globalization. “China is ripping us on trade,” says Donald Trump. Our trade deficit is “an immorality,” says Nancy Pelosi. But it’s not. In my new video, Scott Lincicome of the Cato Institute points out, “Selling us stuff is hardly ripping us off.” He’s right. Our video debunks common misunderstandings about trade.

ABC’s GMA Fails to Mention ‘Biden’ During Segment on Brutal Inflation

Who’s the current U.S. president? ABC’s premier morning news show clearly didn’t let viewers know when covering the crippling food prices Americans are confronting at the grocery store.

Liberals Love the Minimum Wage — Though It Hurts People Liberals Love

On April 1, the new California $20-per-hour minimum wage for fast-food workers went into effect. In signing the bill, California Gov. Gavin Newsom rejected the view that such a wage hike — 25% above the state’s current minimum wage — hurts teenagers who disproportionately benefit from fast-food jobs and for whom this becomes their entry into the job market. Newsom said: “That’s a romanticized…

NY Post’s Nelson Draws Angry KJP Over Report of WH Sexual Harassment

Near the end of a tense White House press briefing Thursday dominated by questions about Israel, the New York Post’s Steven Nelson drew terse replies from Press Secretary Karine Jean-Pierre over his recent reporting on powerful White House aide Anthony Bernal being accused of “bull[ying] and verbally sexually harass[ing] colleagues over more than a decade.”

One More Try at Reducing the Debt

“Neither a borrower nor a lender be.”– Polonius to his son Laertes in “Hamlet” It may be too late given the number of Americans who have willingly allowed themselves to become dependent on government more than themselves, but it’s worth trying. Our $34 trillion debt is unsustainable, according to most economists. If we don’t act soon, we will be worse off than we are now. Our economy…

AP Lobs INSANE Softball Cheering Illegal Aliens as Doocy Brings Heat

For the second day in a row, the Associated Press opened the questioning Tuesday of the ever-inept Karine Jean-Pierre by lobbing a puke-tastic softball so she could bash Donald Trump. This time, it was the insane claim that illegal immigration makes America...well, great. And, in contrast to all this, Fox’s Peter Doocy stood alone on the border crisis.

The View: The Poors Need to Stop Caring About Affording Food

No, it wasn’t an April Fool’s joke. During Monday’s pre-taped edition of ABC’s The View, the liberal ladies whined about average Americans who worried about making ends meet and being able to afford food under the weight of Bidenomics. They seriously argued that Americans were better off under President Biden than they were under President Trump, and brought on a millionaire actress…