Wall St. Journal Columnist Rails Against Billionaires Evading Taxes

The Wall Street Journal has promoted itself as the "Daily Diary of the American Dream," as a promoter of national prosperity. But some columnists find the titans of capitalism too unseemly to support any more.

WATCH: Goldman Sachs CEO Bucks Media with Upbeat 2026 Economic Outlook

Last Friday on CNBC’s Squawk Box, the CEO of Goldman Sachs blew a gaping hole in the never-ending media outrage bait about the Trump economy. Asked by co-host Joe Kernen for his 2026 economic forecast, David Solomon emphatically replied that “the macro setup is quite good,” which shatters doom narratives being promulgated by CNN, The New York Times, and others desperate to…

MRC VP Reacts to Eastman’s Rebuke of Biden’s ‘Fishing Expedition’

MRC Free Speech America Vice President Dan Schneider condemned the large financial institutions that were just exposed for not only debanking customers but also handing over customer info to a politicized “fishing expedition.”

Exclusive: John Eastman Says Banks Must Answer for Debanking

Trump just had to compel financial institutions to fulfill their basic responsibilities of serving their customers instead of fretting over their political beliefs. But as one former Trump attorney put it, this is what the banks should have been doing all along.

President Trump Strikes Back Against Biden Censorship Initiatives

President Donald Trump is taking on financial institutions that, during the Biden administration, were all too happy to debank and financially censor Americans.

Victory: Citigroup Announces End to Heinous Form of Censorship

A massive American financial institution publicly renounced debanking customers for their political views.

DOW DOOM: CNN Cries Potential ‘Great Depression’ in Stock Market

President Donald Trump’s first 100 days haven’t even been completed yet and CNN is already whipping out "Great Depression" scare porn to describe the current stock market under his administration. No, you didn’t misread that.

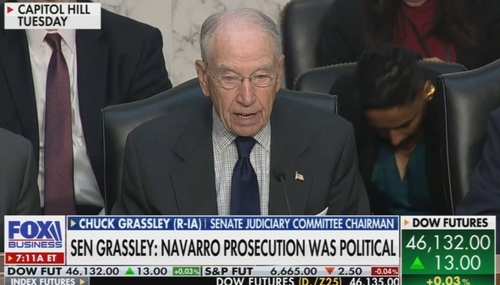

MRC Exclusive: Old Glory Bank President on the Horrors of Debanking

Old Glory Bank co-founder and president Mike Ring blasted years of banking discrimination against conservatives and entire industries in a long overdue Senate hearing on debanking.

Put in Timeout! Google Gets Surprising News from Federal Agency

A federal agency is reportedly planning to put Google under federal supervision, making Google accountable to the government for its actions.

Big Three Ignore Collapse of Vicious Anti-Energy Cabal

A massive asset manager abandoned an alliance dedicated to crushing cheap American energy. ABC, NBC and CBS didn’t bother telling their evening viewers.

State Street Urged to Prioritize Clients' Interests over ESG Agenda

Financial officials from 16 states are calling on State Street Global Advisors, one of the largest asset management firms, to stop deceptively pushing on shareholders only proposals that advance the ideological Environmental, Social and Governance (ESG) agenda, at the expense of their clients’ best financial interests.

Soros-Funded Groups EXPOSED in Gov’t Financial Surveillance Scandal

Two extremist groups financed by billionaire George Soros have been named in the emerging scandal involving federal law enforcement colluding with financial institutions to spy on Americans’ private transactions.

New Report EXPOSES Gov’t-Financial Sector Collusion Against Americans

Apparently Big Tech isn’t the only sector that the U.S. government is exploiting to achieve its dystopian ends against Americans. An explosive new congressional report unveiled another field of abhorrent government collusion with financial institutions to surveil citizens’ private transactions.

Bloomberg News Admits Recession ‘Still Likely’ and ‘Coming Soon’

For all the over-the-top media bluster over how hunky-dory President Joe Biden’s decrepit economy supposedly is, Bloomberg News decided to red-pill itself: The prospect of a recession still threatens America.